Collateralized Mortgage Securities Corporation (Contributed to 2007/2008 Financial Crisis)

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Product Details

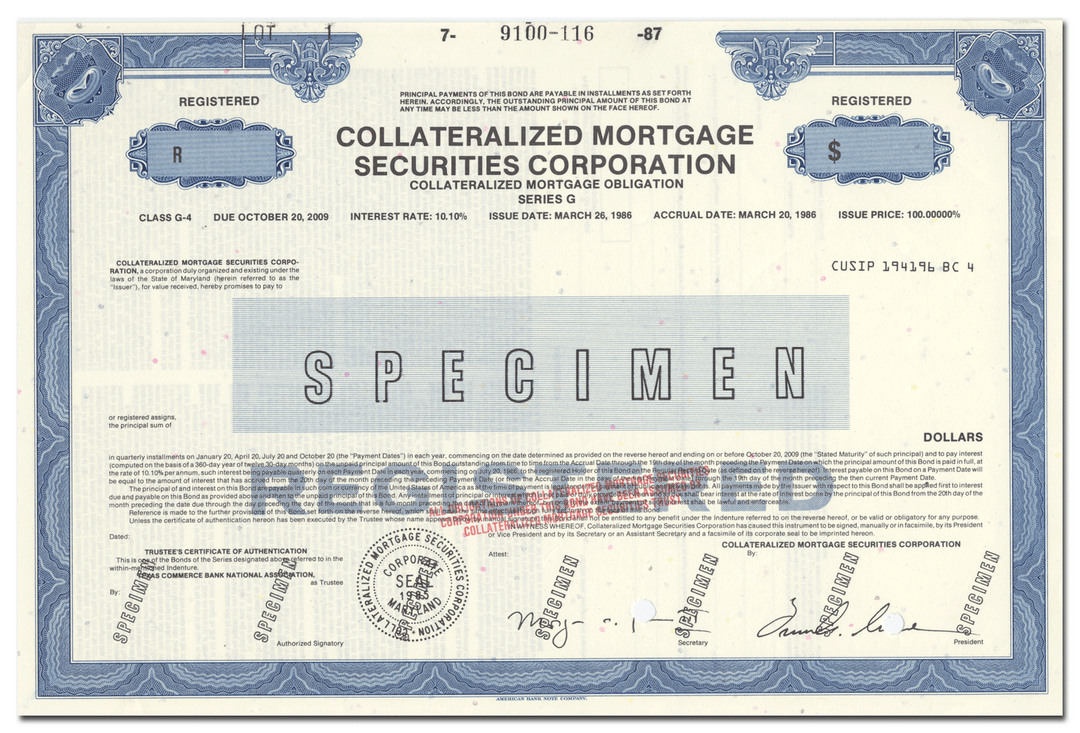

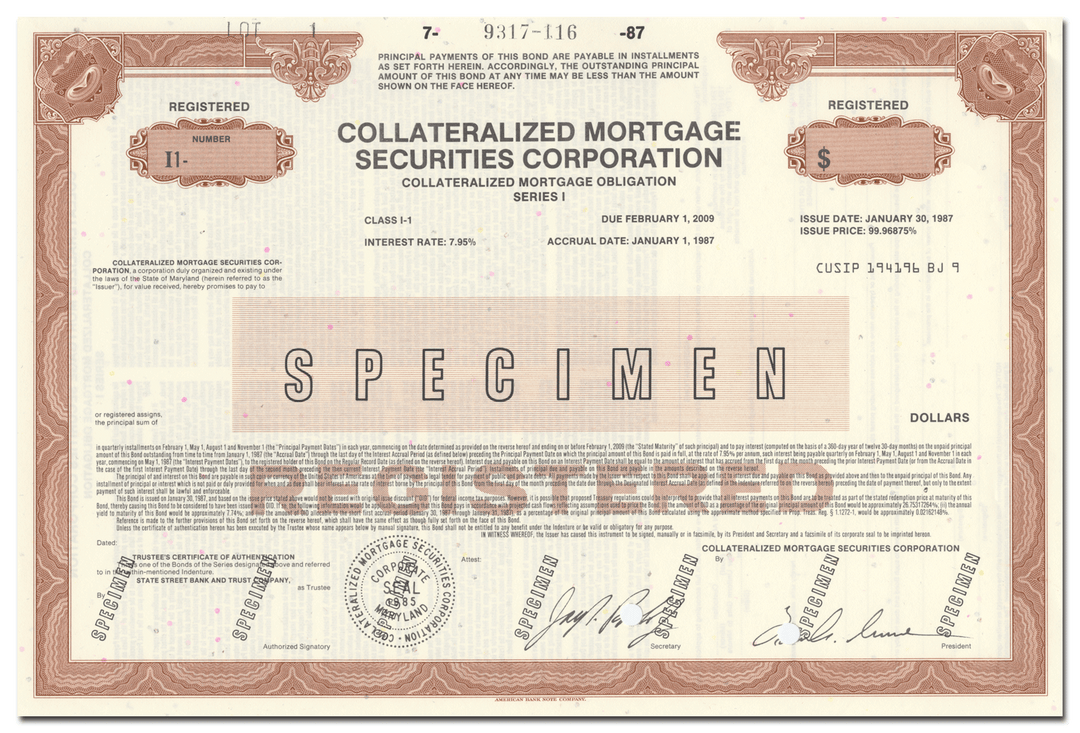

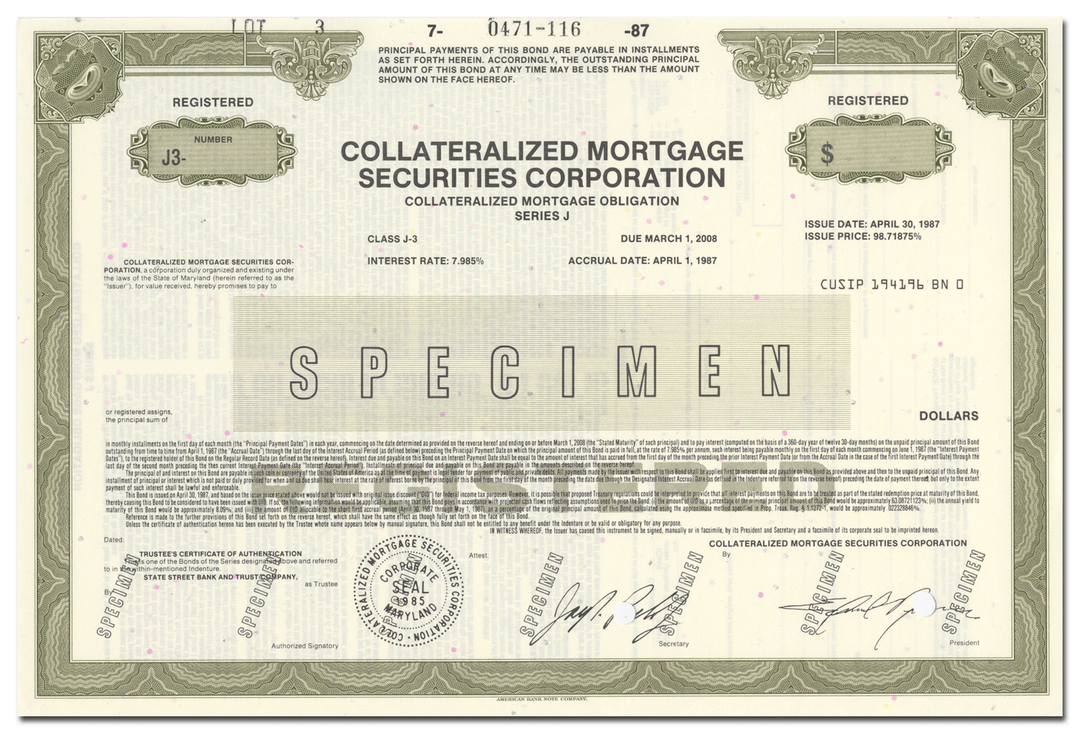

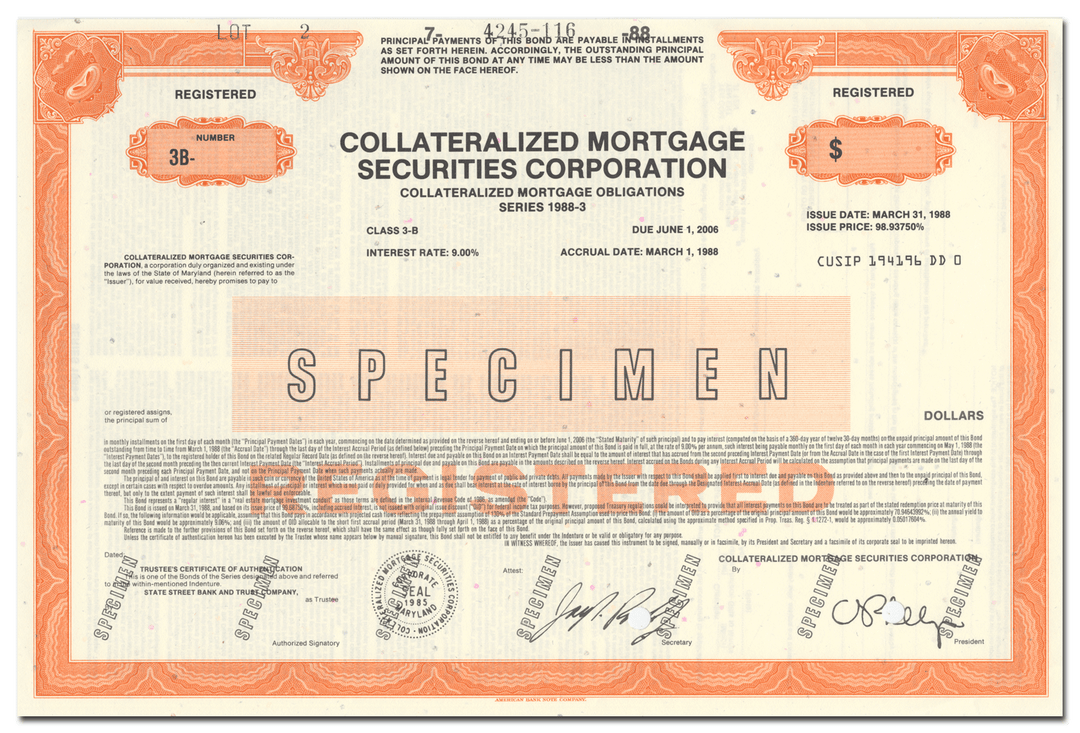

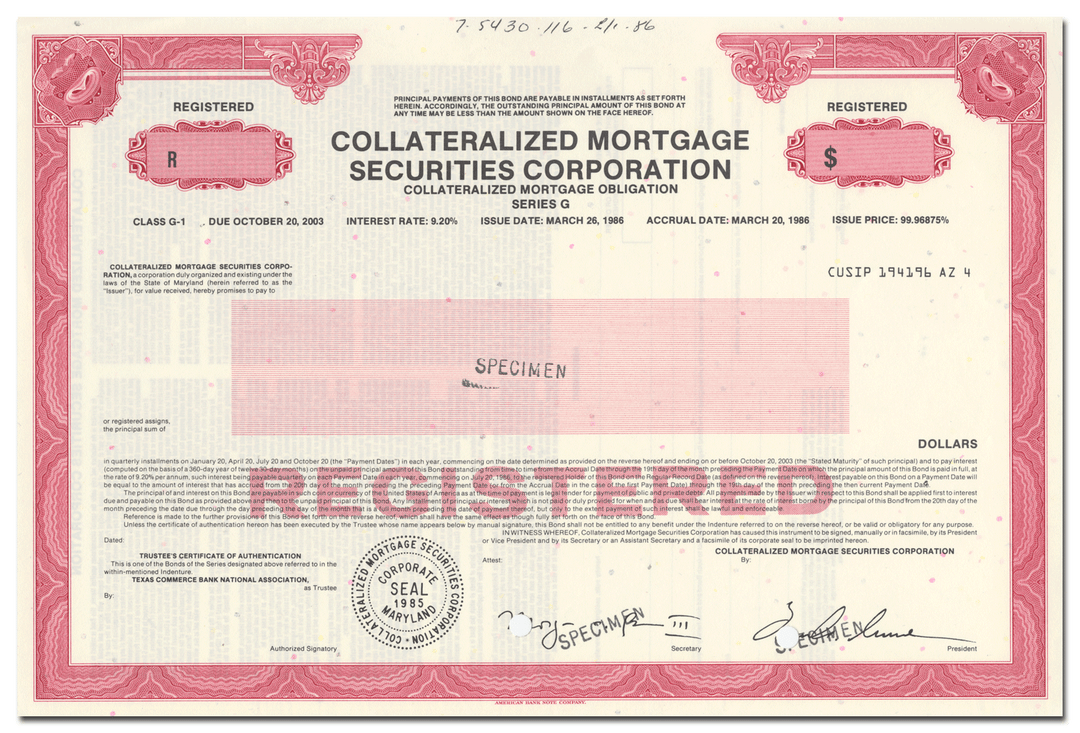

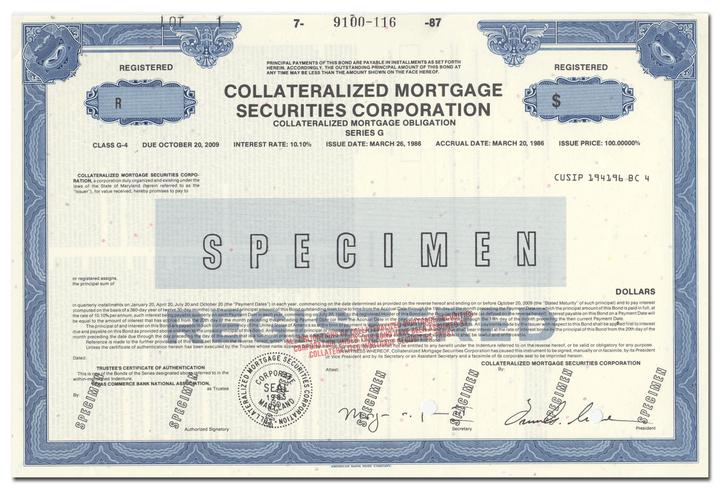

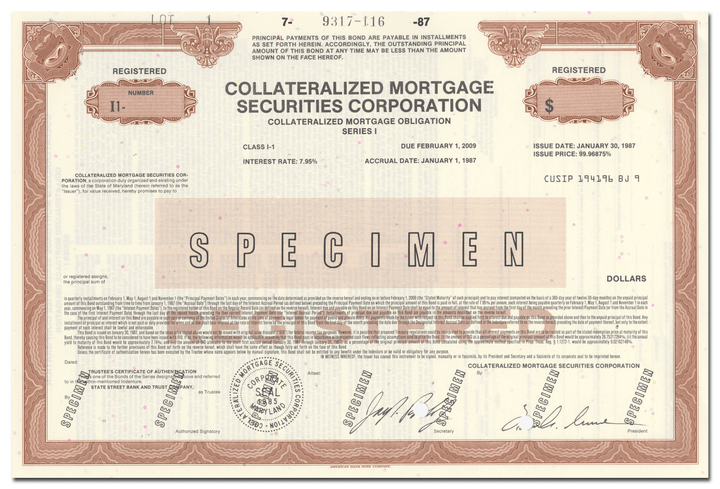

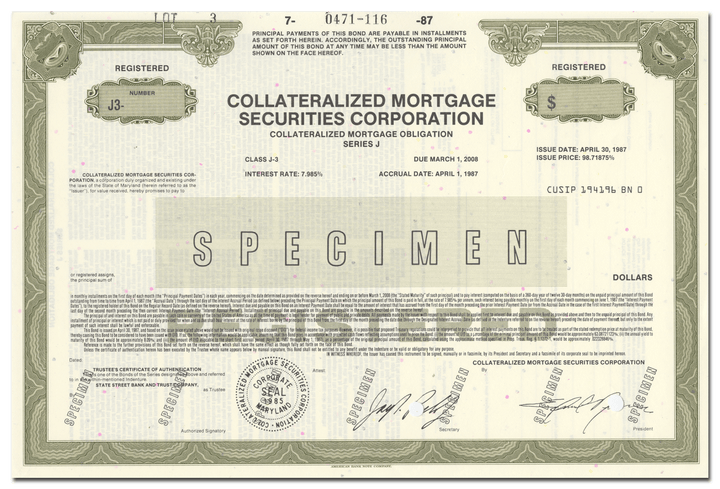

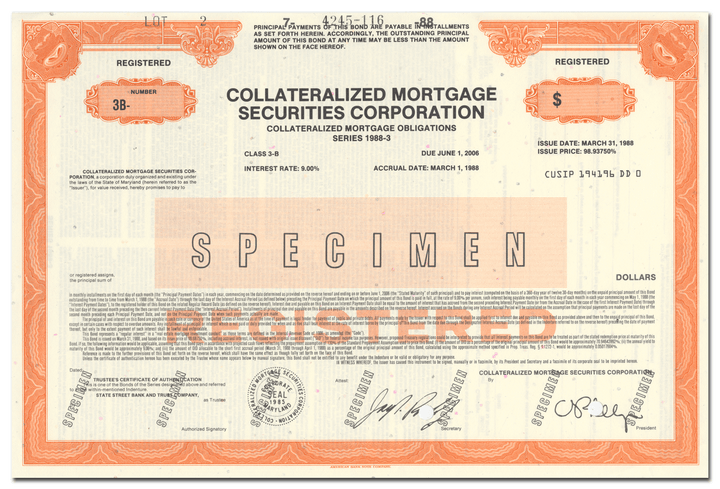

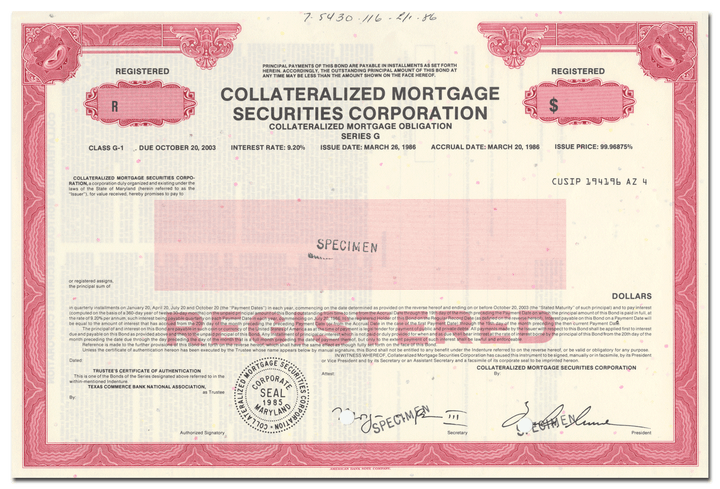

Nicely engraved specimen bond certificate from the Collateralized Mortgage Securities Corporation dating back to the 1980's. This document, which carries the printed signatures of the company President and Secretary, was printed by the American Bank Note Company and measures approximately 12" (w) by 8" (h).

Nice specimen piece.

Images

Historical Context

The Collateralized Mortgage Securities Corporation was incorporated in Maryland and offered investment vehicles centering around "bundled" mortgages.

A collateralized mortgage obligation (which these pieces represent) refers to a type of mortgage-backed security that contains a pool of mortgages bundled together and sold as an investment. Organized by maturity and level of risk, CMOs receive cash flows as borrowers repay the mortgages that act as collateral on these securities. In turn, CMOs distribute principal and interest payments to their investors based on predetermined rules and agreements.

First issued by Salomon Brothers and First Boston in 1983, CMOs were complex and involved many different mortgages. For many reasons, investors were more likely to focus on the income streams offered by CMOs rather than the health of the underlying mortgages themselves. As a result, many investors purchased CMOs full of subprime mortgages, adjustable-rate mortgages, mortgages held by borrowers whose income wasn't verified during the application process, and other risky mortgages with high risks of default.

The use of CMOs has been criticized as a precipitating factor in the 2007-2008 financial crisis. Rising housing prices made mortgages look like fail-proof investments, enticing investors to buy CMOs and other MBSs, but market and economic conditions led to a rise in foreclosures and payment risks that financial models did not accurately predict. The aftermath of the global financial crisis resulted in increased regulations for mortgage-backed securities. Most recently, in December 2016, the SEC and FINRA introduced new regulations that mitigate the risk of these securities by creating margin requirements for covered agency transactions, including collateralized mortgage obligations.

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.