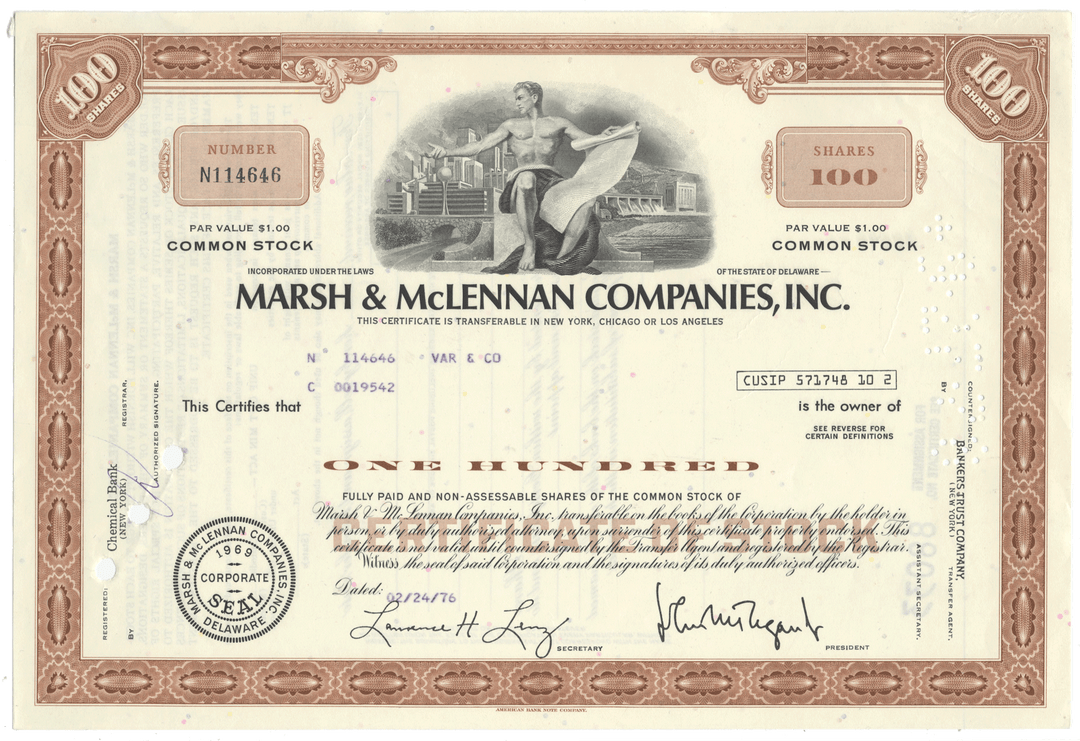

Marsh & McLennan Companies, Inc.

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Product Details

| Company | Marsh & McLennan Companies, Inc. |

| Certificate Type | Common Stock |

| Date Issued | 1970's |

| Canceled | Yes |

| Printer | American Bank Note Company |

| Signatures | Machine printed |

| Approximate Size |

12" (w) by 8" (h) |

|

Product Images |

Representative of the piece you will receive |

| Authentic | Yes |

| Additional Details | NA |

Historical Context

Burroughs, Marsh & McLennan was formed by Henry W. Marsh and Donald R. McLennan in Chicago in 1905. It was renamed as Marsh & McLennan in 1906.

The reinsurance firm Guy Carpenter & Company was acquired in 1923, a year after it was founded by Guy Carpenter. In 1959, it acquired the human resources consulting firm Mercer.

The 1960s were particularly notable for the company's development, including an initial public offering in 1962 and a 1969 reorganization that introduced a holding company configuration, with the company offering clients its services under the banners of separately managed companies.

In 1970, the company purchased Putnam Investments, adding a mutual fund business to its portfolio (and sold it in 2007).

In 1987, Marsh & McLennan acquired the consultancy Temple, Barker & Sloane. Founded in Lexington, Massachusetts in 1969, Temple, Barker & Sloane found quick success in the management consulting industry. In a candid interview with The Christian Science Monitor, Carl Sloane said "In the 1960s, if you had a Harvard MBA, a blue serge suit, and an air travel card, you were a consultant." But as the recession of the 1980's began, he noted that "Now the clients have their own bright MBAs, and you have to offer a range of specialized services."

Temple, Barker & Sloane found themselves specializing in supply chain management, transportation, and financial services. They conducted studies for the United States Coast Guard to determine if the nation should sign onto international oil protocols in the 70s; restructured American Presidential Lines, which became the largest American shipping company in the Pacific in the 80s; and found alternate uses for state-owned railcars when freight trains declined in popularity in the 90s.

In 1971, the chairman of the firm's board gave an expert testimony analyzing the impacts of the Energy Policy and Conservation Act based on Temple, Barker & Sloane's experience in the marine transportation industry. U.S. Congressman Edward Garmatz proclaimed it the best presentation he had "ever seen or heard in [his] many years here in the Congress."

In 1983, the firm was commissioned by the U.S. Department of Agriculture to investigate allegations of poor meat and poultry regulations by environmental activist Ralph Nader. When Nader discovered that the USDA's response had been contracted out, he called the project a "deplorable waste of taxpayers' money." A spokesperson from the Agricultural Department confirmed that Temple, Barker & Sloane had a blanket contract for $100,000 and stated "We did ask them to look into the Nader charges and some other miscellaneous assignments... It's not unusual to have an outside firm take a look at it when serious charges are made against the department." After reading the firm's report, U.S. Representative Tom Harkin decided not to conduct hearings into Nader's charges, declaring that he was "satisfied the Reagan administration is not imperiling the nation's meat and poultry inspection program".

In 1989, Washington, DC-based international management consulting firm Strategic Planning Associates merged with Marsh & McLennan. Founded by former Boston Consulting Group associate Walker Lewis in 1981, Strategic Planning Associates applied concepts of computing to strategy consulting. By 1986, the consultancy was worth $25 million in 1990 US dollars, but just two clients accounted for more than 40% of their revenue. When one of these clients dropped the firm in 1987, Lewis became increasingly convinced that the firm was too small to succeed, admitting to The Washington Post that "a meaningful-sized consulting company has to be 2,000 professionals or larger... it's simple math."

In 1990, Temple Barker & Sloan was merged with Strategic Planning Associates to form Mercer Management Consulting.

At the time of the 2001 September 11 attacks in the United States, the corporation held offices on eight floors, 93 to 100, of the North Tower of the World Trade Center. When American Airlines Flight 11 crashed into the building, its offices spanned the entire impact zone, floors 93 to 99. Everyone present in the company's offices on the day of the attack died as all stairwells and elevators passing through the impact zone were destroyed or blocked by the crash; the firm lost 295 employees and 63 contractors. A memorial to employees lost on 9/11 is located in the plaza adjacent to Marsh McLennan's New York Headquarters at 1166 Avenue of the Americas.

In April 2021, Marsh & McLennan Companies rebranded to Marsh McLennan.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.