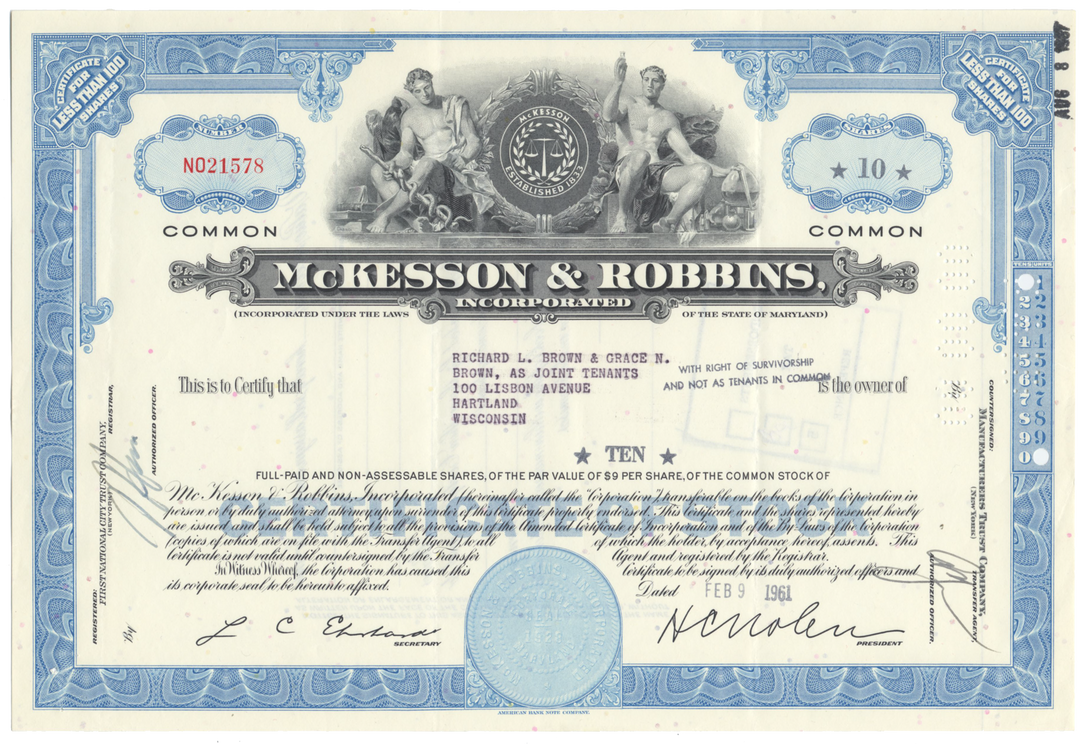

McKesson & Robbins, Inc.

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Representative of the piece you will receive

Over 50 years old

Common stock

1950's and 1960's

Issued, canceled

American Bank Note Company

Machine printed signatures

12" (w) by 8" (h)

NA

Historical Context

McKesson & Robbins was founded in New York City by Charles Olcott and John Mckesson in 1828 as the Charles M. Olcott Co. to import and sell therapeutic drugs and chemicals wholesale. In 1833, the company became Olcott, McKesson & Co.

In 1853, the company becamse McKesson & Robbins,Inc. after a new partner, Daniel Robbins was added. At this point, the company was distributing pharmaceutical products by covered wagon to 17 states and territories from Vermont to California.

Two years later, McKesson & Robbins became one of the first wholesale firms to manufacture drugs. The company’s fluid extracts, tinctures, pills and tablets won medals for its pioneering work.

In the early twentieth-century, McKesson & Robbins persuaded several wholesalers to be its subsidiaries, forming a national drug wholesaling company and becoming the leading distributor of pharmaceutical drug products. This helped the company achieve unprecedented sales and sustain steady growth despite the Great Depression.

The McKesson & Robbins, Inc. scandal of 1938 was one of the major financial scandals of the 20th century. McKesson & Robbins had been taken over in 1925 by Phillip Musica, who had previously used Adelphia Pharmaceutical Manufacturing Company as a front for bootlegging operations.

Musica, a twice-convicted felon, used assumed names to conceal his true identity in taking control of the two companies - Frank D. Costa at Adelphia Pharmaceutical and F. Donald Coster at McKesson & Robbins. Although he was successful in expanding the company’s legitimate business operations, Musica recruited three of his brothers, also working under assumed names, one outside the company and two inside it, to generate bogus sales documentation and to pay commissions to a shell distribution company under their control.

Eventually, McKesson & Robbins treasurer Julian Thompson discovered the distribution company was bogus. It was eventually determined that about $20 million of the $87 million in assets on the company’s balance sheet were phony.

In December 1938, the Securities and Exchange Commission (SEC) opened an investigation and Musica was arrested. Only after he was booked, fingerprinted and released on bond did the authorities realize that “Coster” was in reality Musica. His bond was revoked and he committed suicide before he could be rearrested.

The McKesson & Robbins scandal led to major corporate governance and auditing reforms. The SEC required that public companies have audit committees of “outside” directors and that the appointment of auditors be approved by the shareholders. The American Institute of Accountants adopted audit standards requiring that auditors verify accounts receivable and inventory.

In 1967, Foremost Dairies, a company founded by James Cash Penney that had been headquartered in San Francisco since 1954, acquired McKesson & Robbins in a hostile takeoverto form Foremost-McKesson Inc. The Foremost dairy operations were sold in 1982 and the name changed to the McKesson Corporation but headquarters remained in San Francisco.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.