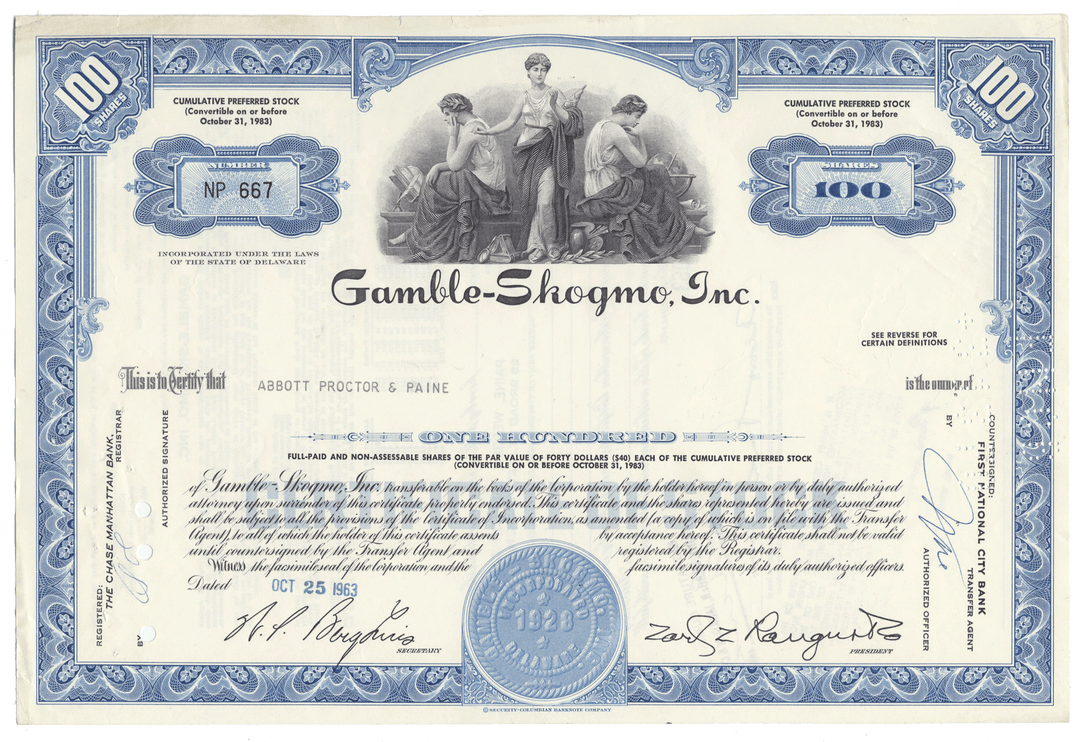

Gamble-Skogmo, Inc.

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Product Details

Company

Gamble-Skogmo, Inc.

Certificate Type

Cumulative Preferred Stock

Date Issued

1950's and 1960's

Canceled

Yes

Printer

Columbian Bank Note Company

Signatures

Machine printed

Approximate Size

12" (w) by 8" (h)

Images

Representative of the piece you will receive

Guaranteed Authentic

Yes

Additional Details

NA

Historical Context

Born at the end of the 19th century, Bertin Gamble and Philip Skogmo were boyhood friends in Arthur, North Dakota (30 miles northwest of Fargo). As young men, they each came separately to Minnesota and worked in a variety of jobs. In 1920, they pooled their resources, borrowed some money and purchased the Hudson-Essex automobile agency in Fergus Falls, Minnesota, which they sold in 1921 after acquiring both the Ford and Dodge agencies in that city. Soon they discovered the sale of auto parts and accessories was the most profitable part of their car dealerships. In March 1925, they opened the first Gamble Auto Supply store in St. Cloud, Minnesota. In 1928, they moved their headquarters to Minneapolis. By 1929, the chain consisted of 55 stores in five states. Eventually, Gamble stores were franchised, and by 1939 there were 1,500 Gamble dealers and 300 corporate stores in 24 states. In 1947, Gamble-Skogmo went public with its first offering of common stock. Philip Skogmo died in 1949.

The original Gambles store in St. Cloud (1925) was so successful that four more stores opened in the Dakotas within ten weeks. The partners decided to incorporate Gamble-Skogmo, Incorporated in 1928, and shortly thereafter moved the headquarters and central warehousing to Minneapolis. By the end of the year there were 55 Gambles retail outlets in five states. By 1933 they had added 100 more outlets and grown annual corporate sales to $10 million. Franchised dealerships were inaugurated in 1933 and, in 1941, clothing and other "softlines" were added to the staple "hardlines" business, a diversification made necessary by the unavailability of consumer hard goods during World War II.

The corporation went international in 1945 with the acquisition of the 270 Macleod hardlines retail outlets in Western Canada. Gamble-Skogmo went public in 1947, and partner Phil Skogmo died in 1949. The company expanded into mass merchandising by forming its Tempo Stores division in 1962, which grew into a chain of 50 discount shopping centers. The following year saw the acquisition of the 286-store Stedmans chain, which operated throughout Canada. In 1964 Gamble-Skogmo entered the catalog merchandising field by acquiring the large Aldens operation, including its life insurance subsidiary. In 1966 Founder's, Incorporated was merged into the corporation, bringing it a women's wear chain (Mode O'Day), and a group of variety stores including Cussins & Fearn and Rasco stores, and Buckeye Mart Discount Department Stores. In the same year the corporation also acquired the House of Fabrics chain and formed Gambles Import Corporation to direct the purchase of goods made overseas. In 1967 Gamble-Skogmo formed a real estate subsidiary, Gamble Development Company, to develop and lease shopping centers, and also acquired the 400-store Red Owl supermarket chain, which also included 62 Snyder's drug stores. Between 1969 and 1972 the corporation several leasing business lines, launched Gambles home improvement centers, and acquired the 24-store Woman's World clothing chain.

From the mid-1940s to the end of the 1970s, Gamble and Skogmo diversified their businesses into many new endeavors, including a discount division, financial services, real estate, and retail businesses such as Aldens mail order company, Woman's World Shops, Red Owl Grocery and Snyder Drug stores. At the end of this period of growth, Gamble-Skogmo was the 15th largest retailer in the United States with 4,300 stores and 26,000 employees in 39 states and Canada. In 1977, Bert Gamble retired from the company. In 1978, they attempted a takeover of Washington, DC-based retail conglomerate Garfinckel, Brooks Brothers, Miller & Rhoads, Inc. Gamble-Skogmo purchased a 20-percent share from the Joseph R. Harris family, thereby gaining a controlling interest in the conglomerate. A court suit resulted in an agreement that Gamble-Skogmo would not acquire any more stock in Garfinckel.

Gamble served as president and chief executive officer of Gamble-Skogmo, Incorporated, the umbrella firm that controlled the myriad operating companies, into 1963. He continued to serve as chairman of the board of directors and corporate CEO until retiring in September 1977.

In 1980, it was sold to the Wickes Corporation of California. The purchase was highly leveraged, the combined companies struggled, and in 1982 Wickes filed for bankruptcy. In the subsequent reorganization, the Gamble-Skogmo empire was sold off in pieces or, in the case of Aldens, closed. In 1986, Bert Gamble died. Following the Wickes' entry into receivership in 1984, the remaining Gamble-Skogmo businesses were returned to a new company formed by five Gambles Division officers, who reincorporated Gamble-Skogmo, Incorporated.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.