Very Rare BEAR STEARNS Working Proof

- Guaranteed authentic document

- Orders over $75 ship FREE to U. S. addresses

Product Details

Company

Bear Stearns Companies, Inc.

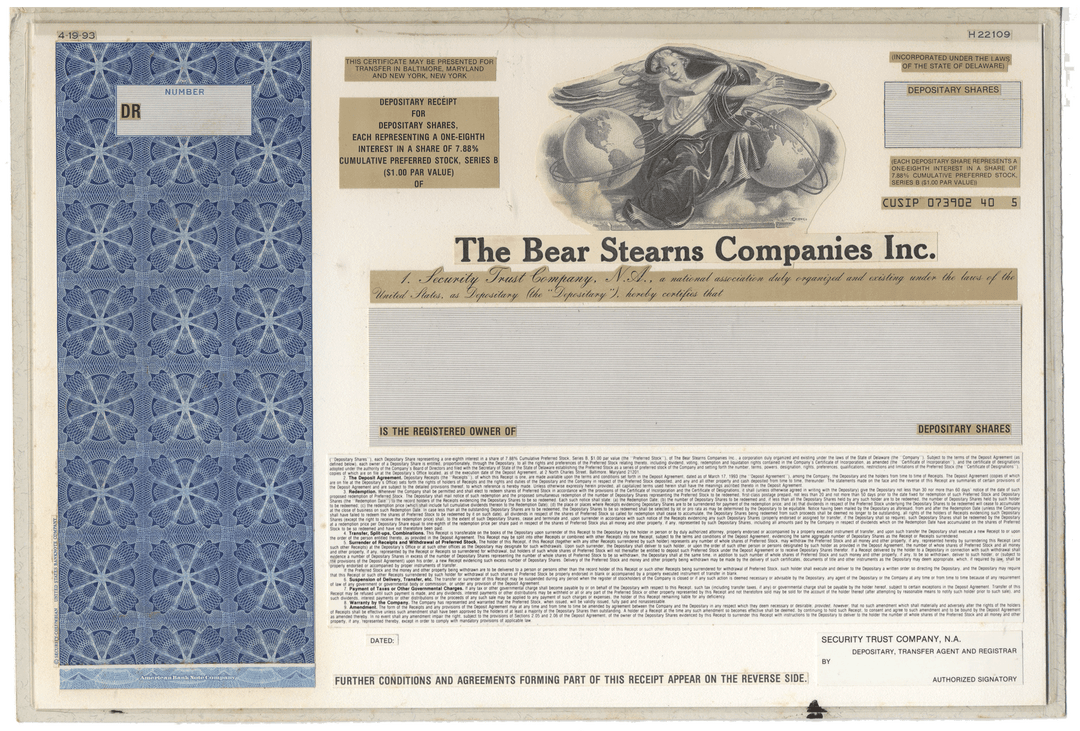

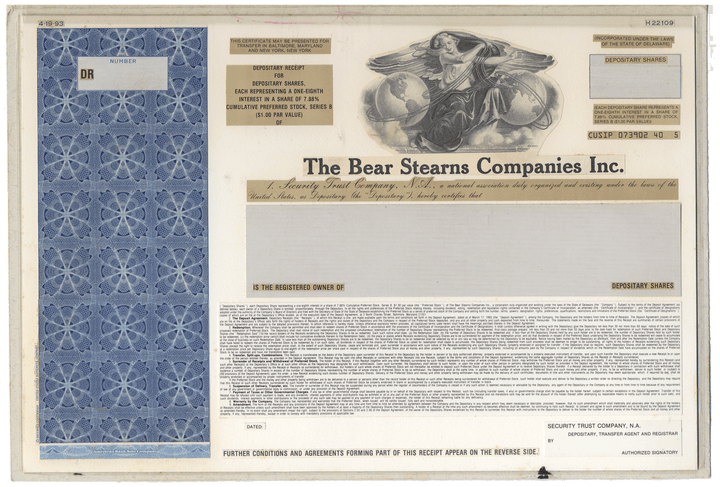

Certificate Type

Working Proof of the company's Depositary Shares

Time Period

1990's

Printer

American Bank Note Company

Format & Approximate Size

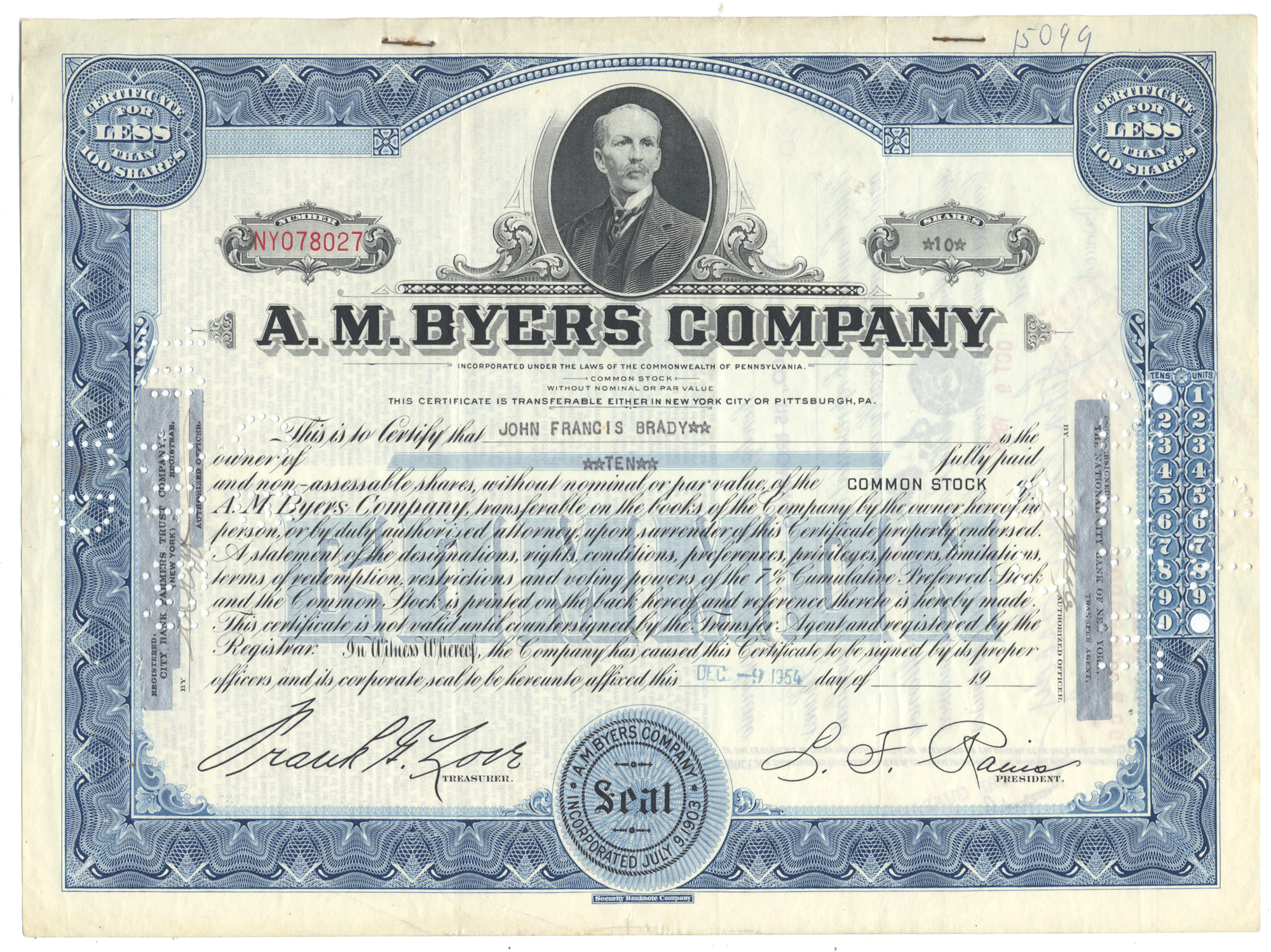

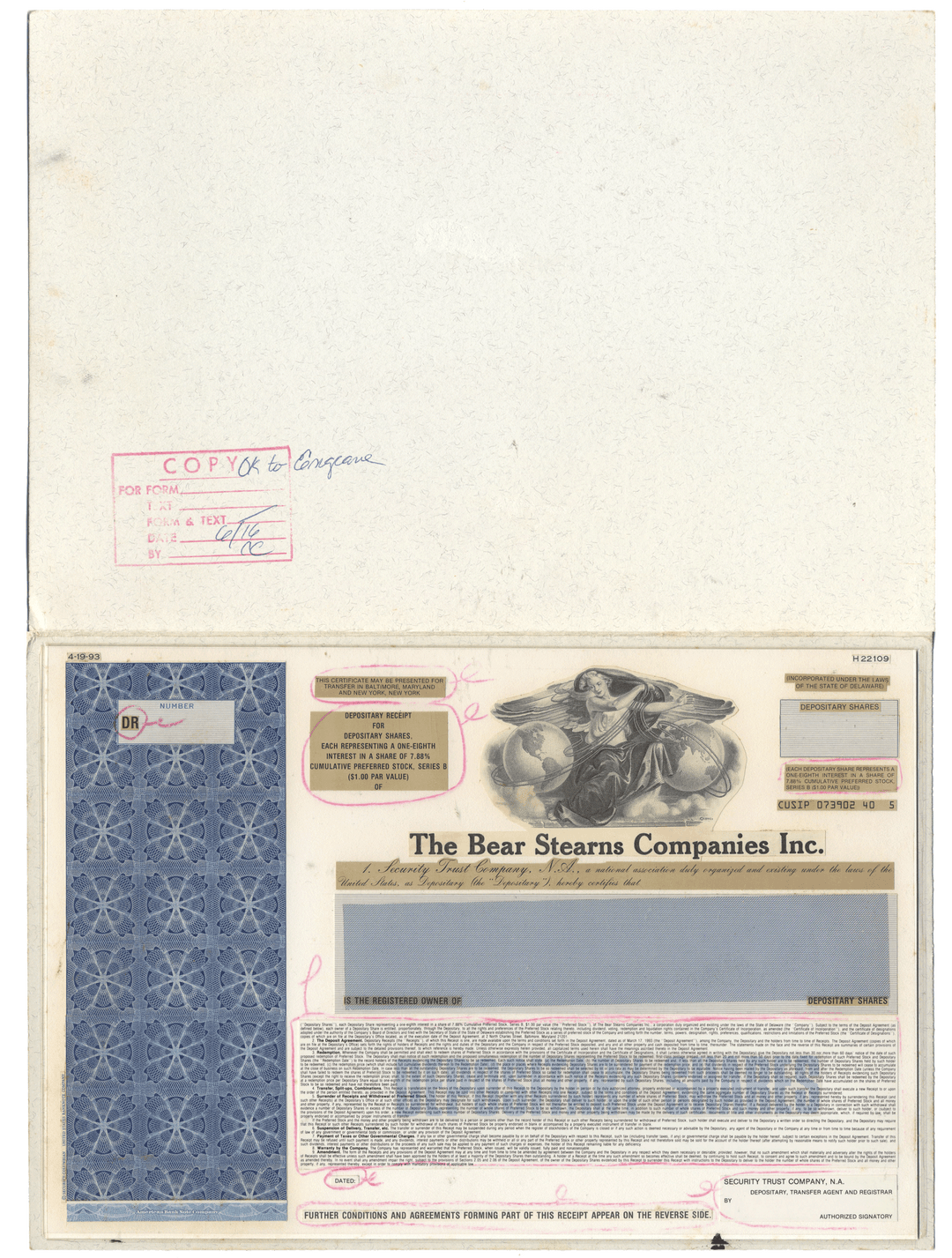

This proof is housed in a standard 12" x 8 1/2" cardboard folder. The proof is protected by a clear protective and editing layer which can be lifted away, and is adhered to the folder itself.

Images

You will receive the exact proof pictured as it is the only one of it's kind. The first image shows the proof in the folder with the cover flipped up and the protective/editing plastic layer in place atop the proof. The second image shows the proof with the plastic layer lifted away and out of view.

Guaranteed Authentic

Yes

Additional Details

Fascinating piece of financial history from this failed investment bank!

Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that famously failed during the 2008 financial crisis and the Great Recession. After its closure, it was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

In the years leading up to the failure, Bear Stearns was heavily involved in securitization and issued large amounts of asset-backed securities which were, in the case of mortgages, pioneered by Lewis Ranieri, "the father of mortgage securities." As investor losses mounted in those markets in 2006 and 2007, the company actually increased its exposure, especially to the mortgage-backed assets that were central to the subprime mortgage crisis. In March 2008, the Federal Reserve Bank of New York provided an emergency loan to try to avert a sudden collapse of the company. The company could not be saved, however, and was sold to JPMorgan Chase for $10 per share, a price far below its pre-crisis 52-week high of $133.20 per share, but not as low as the $2 per share originally agreed upon.

The collapse of the company was a prelude to the 2008 financial crisis and the meltdown of the investment banking industry in the United States and elsewhere. In January 2010, JPMorgan ceased using the Bear Stearns name.

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.