Very Rare FEDERAL HOME LOAN MORTGAGE (FREDDIE MAC) Working Proof

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Product Details

Company

Federal Home Loan Mortgage Corporation

Certificate Type

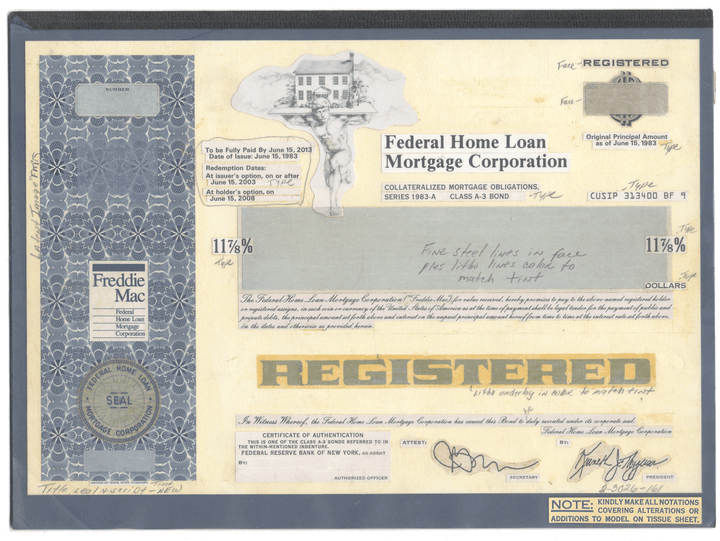

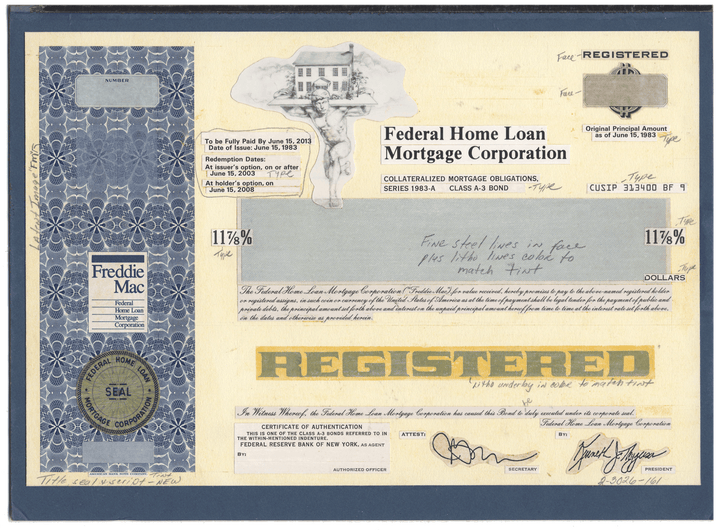

Working Proof of the company's Collateralized Mortgage Bond

Time Period

1980's

Printer

American Bank Note Company

Format & Approximate Size

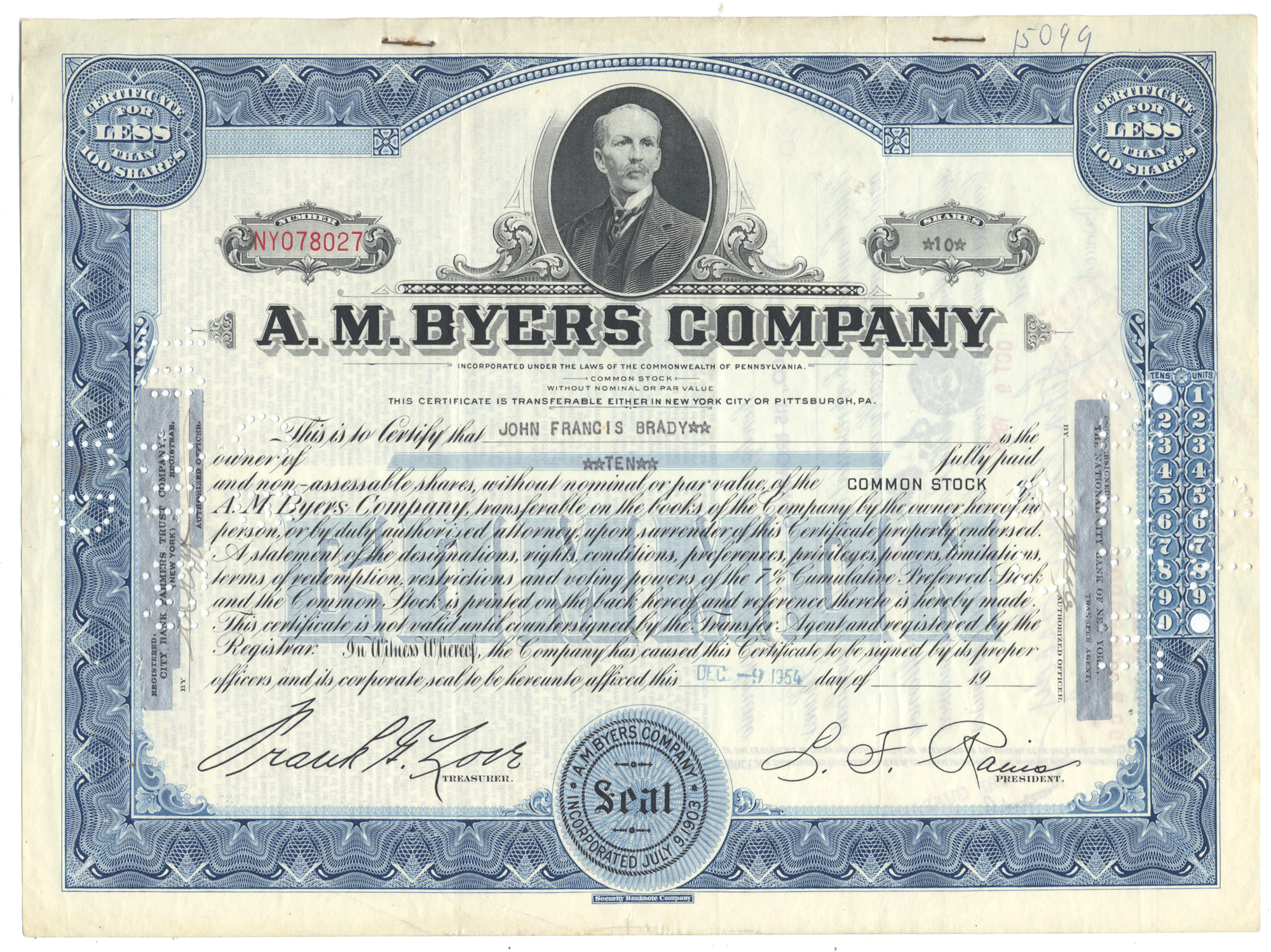

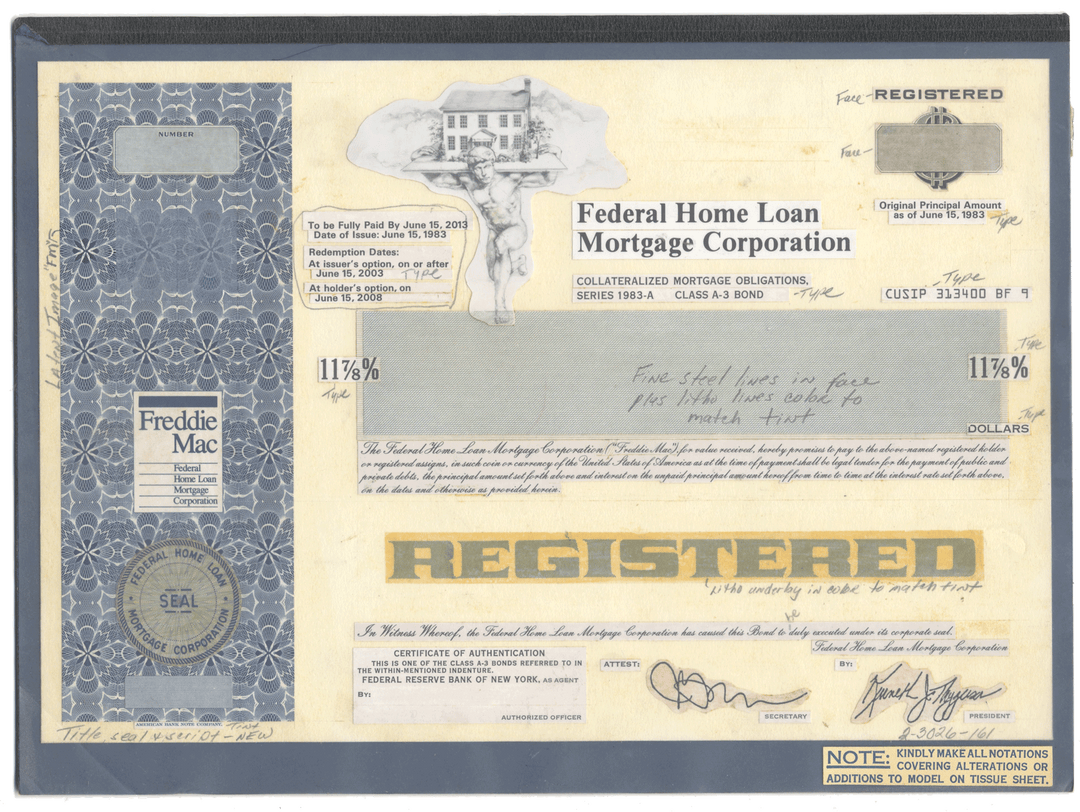

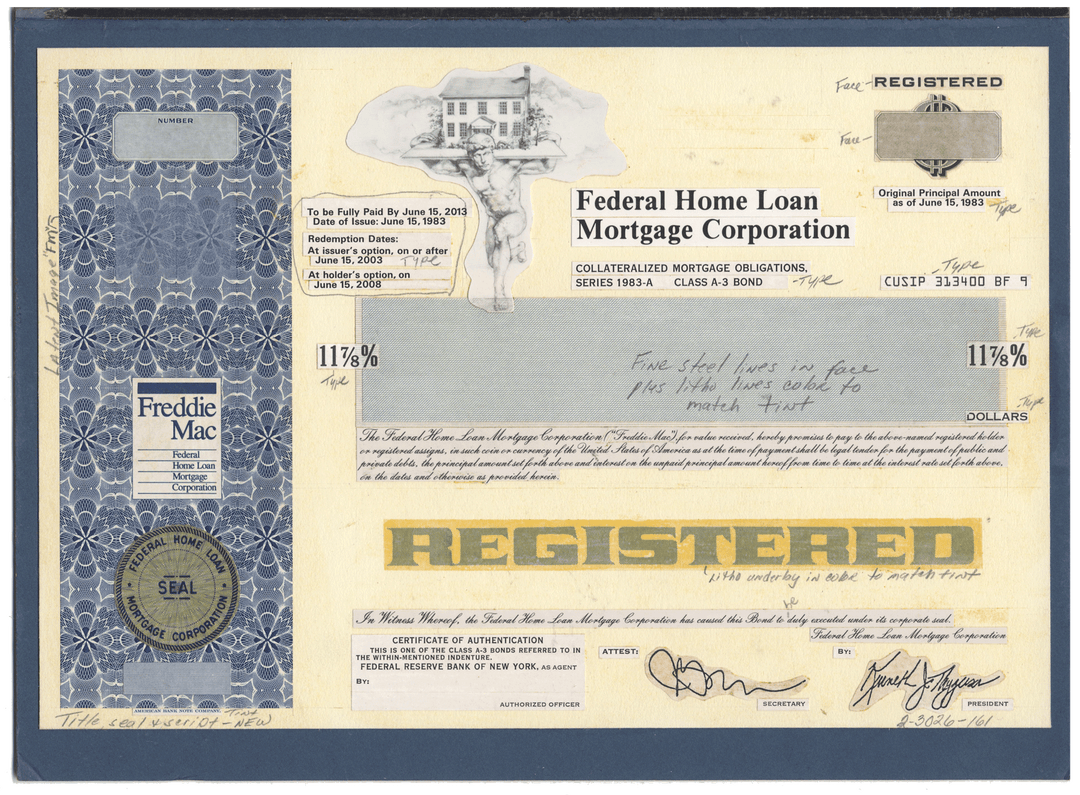

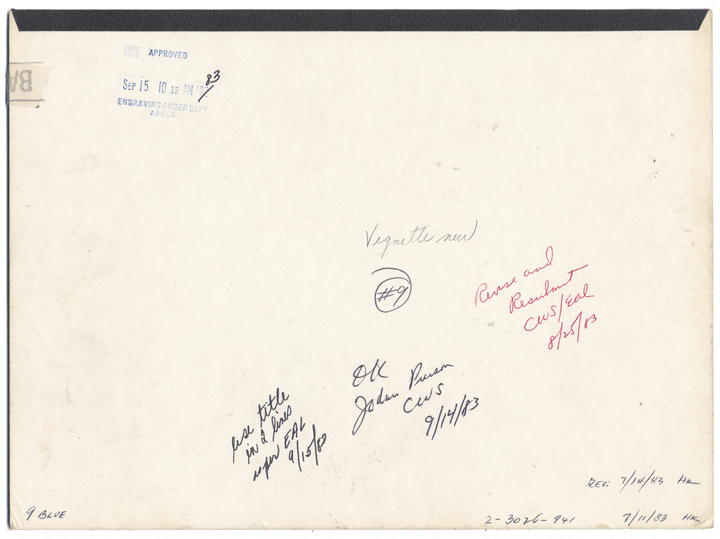

This proof is adhered to a thick 12" x 8 1/2" piece of cardboard. The proof is protected by a "flip up" clear protective and editing layer and is adhered to the folder itself.

Images

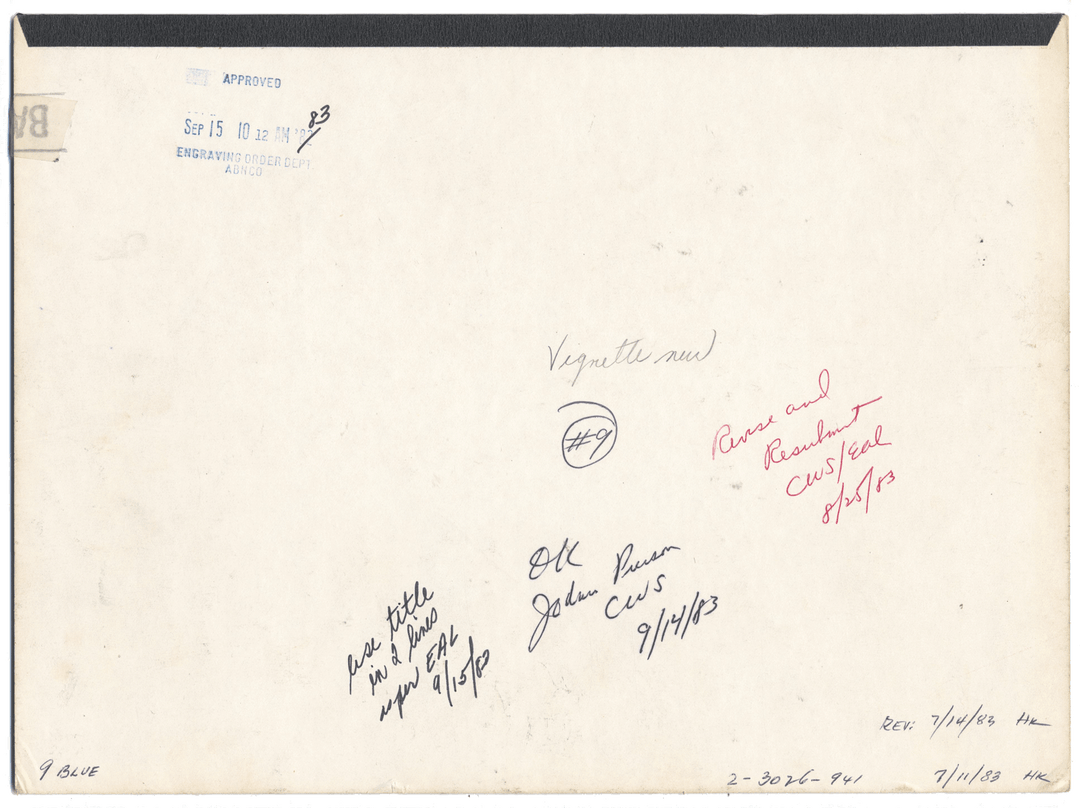

You will receive the exact proof pictured as it is the only one of it's kind. The first picture shows the proof with the edit layer lying atop the piece. The second picture shows just the proof with the plastic layer lifted out of view. The third picture shows the back of the cardboard with various notations and approvals.

Guaranteed Authentic

Yes

Additional Details

Fascinating piece of financial history from this goverment financed financial giant!

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a government-sponsored enterprise (GSE), headquartered in Tysons, Virginia. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with its sister organization, the Federal National Mortgage Association (Fannie Mae), Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

On September 7, 2008, Federal Housing Finance Agency (FHFA) director James B. Lockhart III announced he had put Fannie Mae and Freddie Mac under the conservatorship of the FHFA (see Federal takeover of Fannie Mae and Freddie Mac). The action has been described as "one of the most sweeping government interventions in private financial markets in decades". As of the start of the conservatorship, the United States Department of the Treasury had contracted to acquire $1 billion in Freddie Mac senior preferred stock, paying at a rate of 10% per year, and the total investment may subsequently rise to as much as $100 billion. Shares of Freddie Mac stock, however, plummeted to about one U.S. dollar on September 8, 2008, and dropped a further 50% on June 16, 2010, when the stocks delisted due to falling below minimum share prices for the NYSE. In 2008, the yield on U.S Treasury securities rose in anticipation of increased U.S. federal debt. The housing market and economy eventually recovered, making Freddie Mac profitable once again.

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.