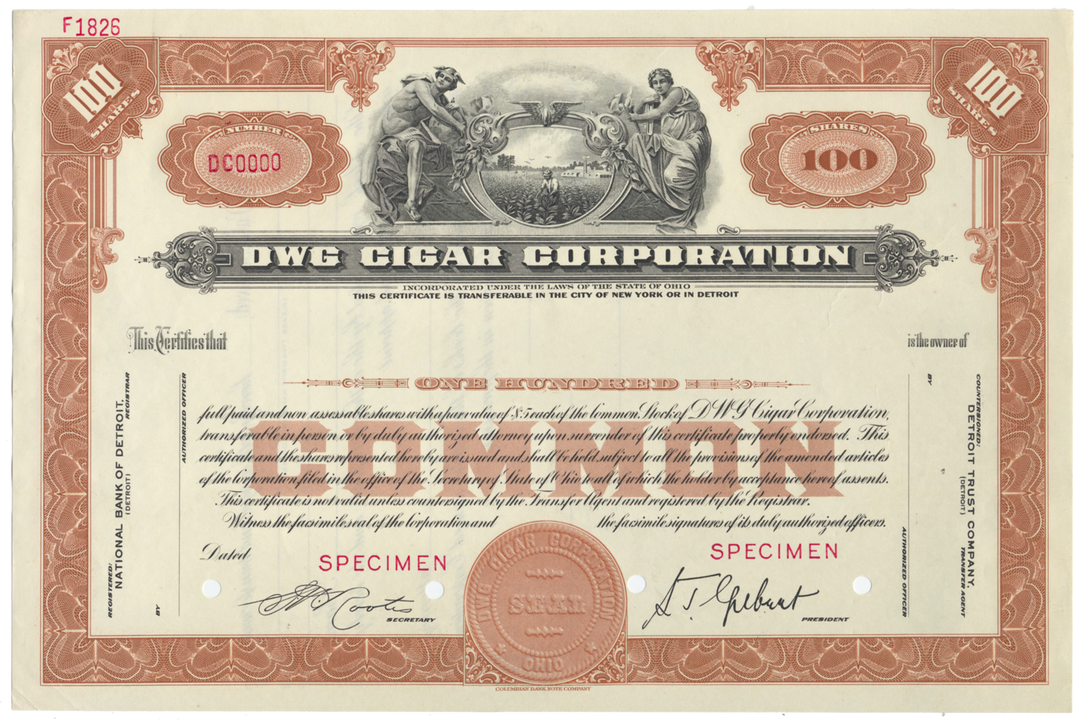

DWG Cigar Corporation (Eventually Became Wendy's)

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Product Details

Company

DWG Cigar Corporation

Certificate Type

Common Stock

Date Issued

Specimen, circa 1940's

Canceled

Yes

Printer

Columbian Bank Note Company

Signatures

Machine printed

Approximate Size

11 1/2" (w) by 7 1/2" (h)

Images

Representative of the piece you will receive

Guaranteed Authentic

Yes

Additional Details

NA

Historical Context

On January 23, 1929, Deisel-Wemmer incorporated as Deisel-Wemmer-Gilbert Corporation (DWG), after it was acquired by an investment group. DWG was a small firm, and to maintain market share, it purchased other small cigar companies like Odin cigars in 1930 and the Bernard Schwartz Cigar Corporation in 1939. The company changed its name to DWG Cigar Corporation on May 15, 1946.

Another series of acquisitions began in 1948 with the Nathan Elson Company, followed by A. Sensenbrenner & Sons in 1955, and in 1956, Chicago Motor Club Cigar and Reading, Pennsylvania-based Yocum Brothers. With the decline of the cigar market due to medical advisories, many smokers switched to cigarettes, which were believed to be safer at the time.

DWG streamlined cigar operations and began looking for other businesses that would suit DWG's wholesale and distribution strength. DWG sold or closed their remaining cigar operations in 1966. After a failed attempt at purchasing the Allegheny Pepsi bottling company in 1965, DWG Cigar changed its name to DWG Corporation.

DWG used its cash from the cigar operation sale to purchase a 12% share in the National Propane Corporation. The New York Stock Exchange delisted DWG in 1967 Security Management Company, headed by Victor Posner, a major investor in DWG saw potential with the company as it was bold to sell its main operation. Posner saw it as a good takeover vehicle and became the controlling shareholder of DWG. Posner was the chairman of the board and president of every company that the Security Management Company owned. This included DWG and NVF, a vulcanized fiber manufacturer that controlled the other half of Posner's companies.

NVF controlled Sharon Steel Corporation, one of the country's largest specialty steel manufacturers, which led to legal trouble. Posner sat on Sharon Steel's pension trustee board and directed the pension board to invest in Posner-owned properties. In 1971, the SEC sued, after which Posner agreed not to sit on any pension board of any of his companies. After more acquisitions from 1982 to 1985, DWG faced heavy debt. Posner approached one of his backers, Carl Lindner, Jr. for assistance, but by 1986, Lindner's American Financial Corporation had acquired warrants for more than 30% of DWG's shares. Linder did not exercise the warrants, but forced Posner to reduce his pay from DWG.

Posner also started selling DWG assets, including Foxcroft, Enro and the citrus subsidiaries. DWG bought beverage company Royal Crown Cola and its fast food subsidiary Arby's through a hostile takeover in 1984. An investor that Posner contacted to help get Sharon Steel out of bankruptcy told Posner that his lawyer, Andrew Heine, was considering buying Fischbach Corp. Just short of Fischbach being sold, Heine's Granada Investments Company made a bid for DWG at $22 per share. Posner converted all DWG options into voting shares but was unable to vote them due to an Ohio judge's order. Granada sued Posner for not taking the bid seriously and Posner countersued, stating the bid had no merit. Posner lost the case in 1991 and was forced to pay $5.5 million to Granada. The judge also noted other investigations into illegal stock trading in the Fischbach acquisition and Posner's compensation, and added three court-appointed directors to DWG's board as audit, compensation, and intercorporate transactions committees. Posner stopped the appointed directors from presenting their report to the full board, forcing Judge Lambros to convert 50% of Security Management Company ownership in DWG to preferred shares and to sell the remaining common stock.

Posner resigned as chair of DWG in 1992 and sold his shares to Trian Group, a New York-based investment partnership led by Nelson Peltz and Peter May. Shareholders agreed to drop their longstanding lawsuits, claiming that DWG had been "raided" and "stripped". DWG's name was changed to Triarc Companies, Inc in 1993 and Peltz served as CEO of the company from 1993 through 2007, during which time the company sold several of its subsidiaries in order to focus on their food and beverage operations.

In August 1995, Triarc purchased Mistic Brands, Inc. from Joseph Victori Wines, Inc. for $97 million. Triarc sold off its textile companies in 1997. In 1997, Triarc acquired Snapple Beverages from Quaker Oats for $300 million, three years after Quaker Oats had purchased Snapple from leveraged buyout firm Thomas H. Lee Partners in 1994 for $1.7 billion. Cable Car Beverage Corporation, maker of Stewart's Root Beer, was purchased by Triarc in November 1997 for $31 million in stock. Triarc sold National Propane Corporation in 1999. Snapple, Mistic, and Stewart's (formerly Cable Car Beverage) was sold by Triarc to candy company Cadbury Schweppes in 2000 for $1.45 billion.

In October of that same year, Cadbury Schweppes purchased Royal Crown from Triarc. On April 24, 2008, Triarc announced the acquisition of Wendy's International, the fast food company. The transaction was part of the company's strategy to transition from a holding company for numerous businesses into a true food and beverage company. The purchase was finalized on September 15, 2008, when shareholders of both Triarc and Wendy's agreed to the terms. As part of the terms, the name was changed to Wendy's/Arby's Group, Inc.

In January 2011, the group announced it was divesting itself of the Arby's chain, which had seen lackluster sales growth since the acquisition of Wendy's in 2008. It was officially announced on January 20, 2011 that the group would seek a buyer for its Arby’s Group with 3,700 restaurants. On June 13, 2011, Wendy's/Arby's Group Inc. announced that it would sell the majority of its Arby's chain to Roark Capital Group, maintaining an 18.5% stake in the company.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.