Celanese Corporation

- Guaranteed authentic document

- Orders over $75 ship FREE to U. S. addresses

Product Details

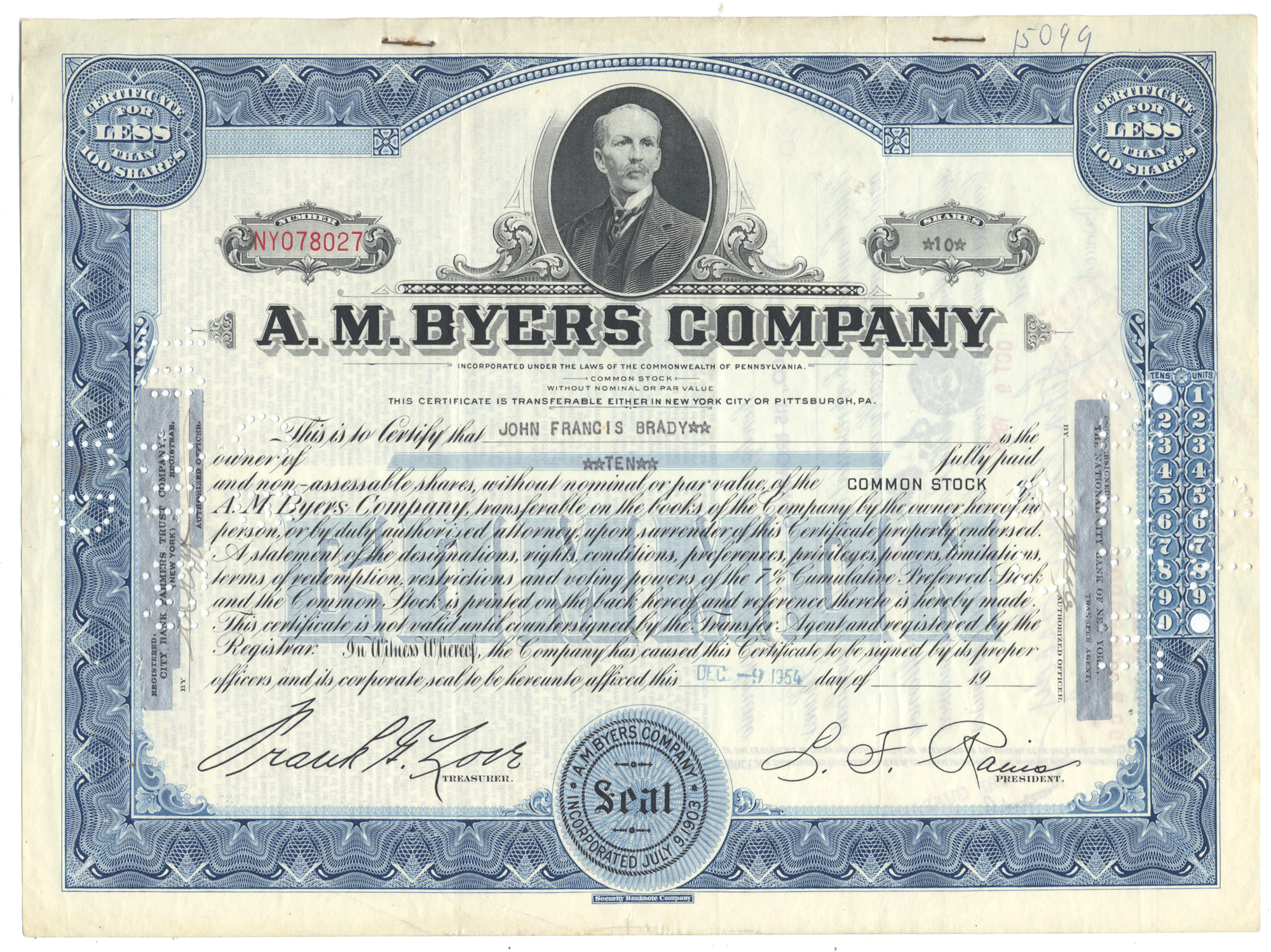

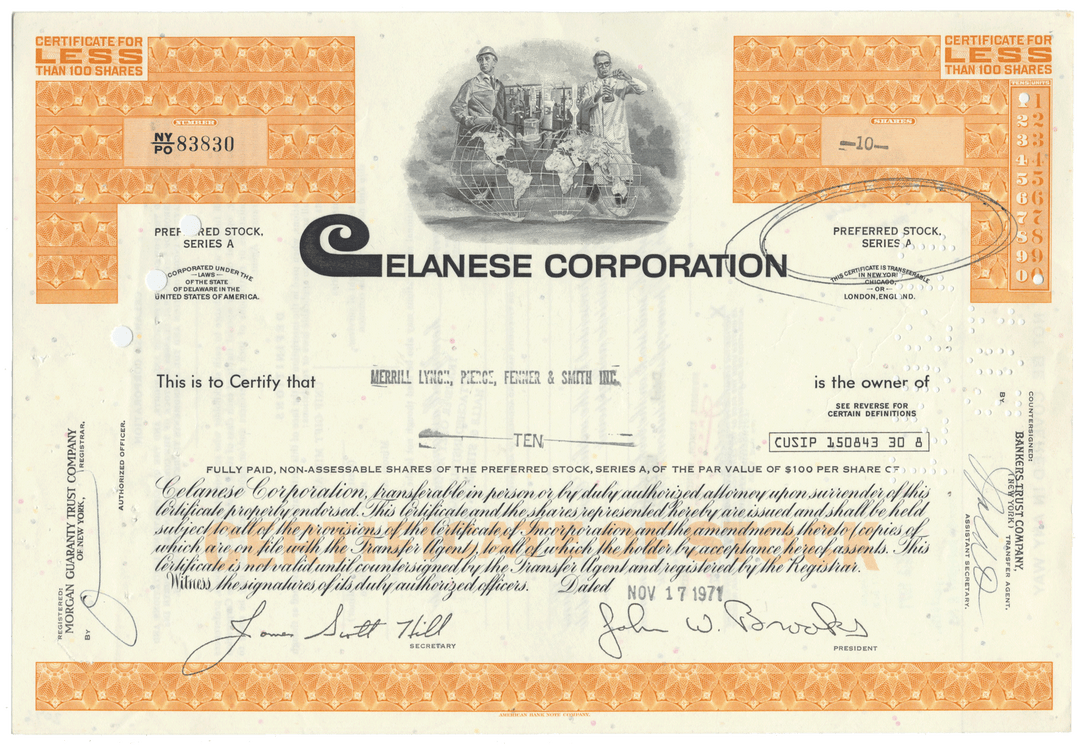

Certificate Type

Common/Preferred Stock

Date Issued

November 17, 1971

Canceled

Yes

Printer

American Bank Note Company

Signatures

Machine printed

Approximate Size

12" (w) by 8" (h)

Additional Details

NA

Historical Context

In 1918, the American Cellulose & Chemical Manufacturing Company was founded in New York City by Camille Dreyfus.

The American Cellulose and Chemical Manufacturing Co. Ltd plant in Cumberland, Maryland was set up during World War I to produce cheaper fabric for airplane manufacturing. The plant location was chosen inland to protect against Zeppelin attacks. It was also situated in proximity to a ready source of water at the Potomac River and easy access to coal supplies and railroad lines. After a series of delays, actual production began in 1924 with a series of cellulose acetate commercial fabrics and yarns intended as alternatives to silk. The plant was closed in 1983, and was later torn down to provide a space for a new state prison.

In 1927, the American Cellulose & Chemical Manufacturing Company changed its name to Celanese Corporation of America.

The company was best known for manufacturing Fortrel polyester for men's and women's clothing, acetate for consumer products (introducing the clear window in toy packages), and chemicals for use in paints and other items.

Celanese bought operations of Imperial Chemicals Incorporated in 1982. This included the Fiber Industries Incorporated plant in Salisbury, North Carolina, a part of Invista since 2004.

In 1986, its pharmaceutical business was spun off as Celgene, and, in 1987, Celanese Corporation was acquired by Hoechst and merged with its American subsidiary, American Hoechst, to form Hoechst Celanese Corporation.

In 1998, in a $2.7 billion deal, Hoescht Celanese sold its Trevira division to a consortium between Houston-based KoSa, a joint venture of Koch Industries and IMASAB S.A. of Mexico, and Grupo Xtra of Mexico.

Also in 1998, Hoechst combined most of its industrial chemical operations in a new company, Celanese AG, and, in 1999, Hoechst spun off Celanese AG as a publicly traded, German corporation, traded on both the Frankfurt and New York stock exchanges.

On December 16, 2003, the U.S. private equity firm Blackstone Group announced a takeover offer for Celanese, after two years of wooing management. Shareholders formally approved the offer from Blackstone on June 16, 2004, and Blackstone completed the acquisition of Celanese AG. The company was delisted from the New York Stock Exchange, and Blackstone changed the entity's name to Celanese Corporation. Under Blackstone, a number of streamlining initiatives were undertaken, and several acquisitions were made.

On January 21, 2005, Celanese Corporation conducted an initial public offering and became a publicly traded corporation traded on the New York Stock Exchange under the symbol "CE". When Blackstone sold the last of its shares in 2007, it had made five times what it had invested and it, and its co-investors collected a $2.9 billion profit.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.