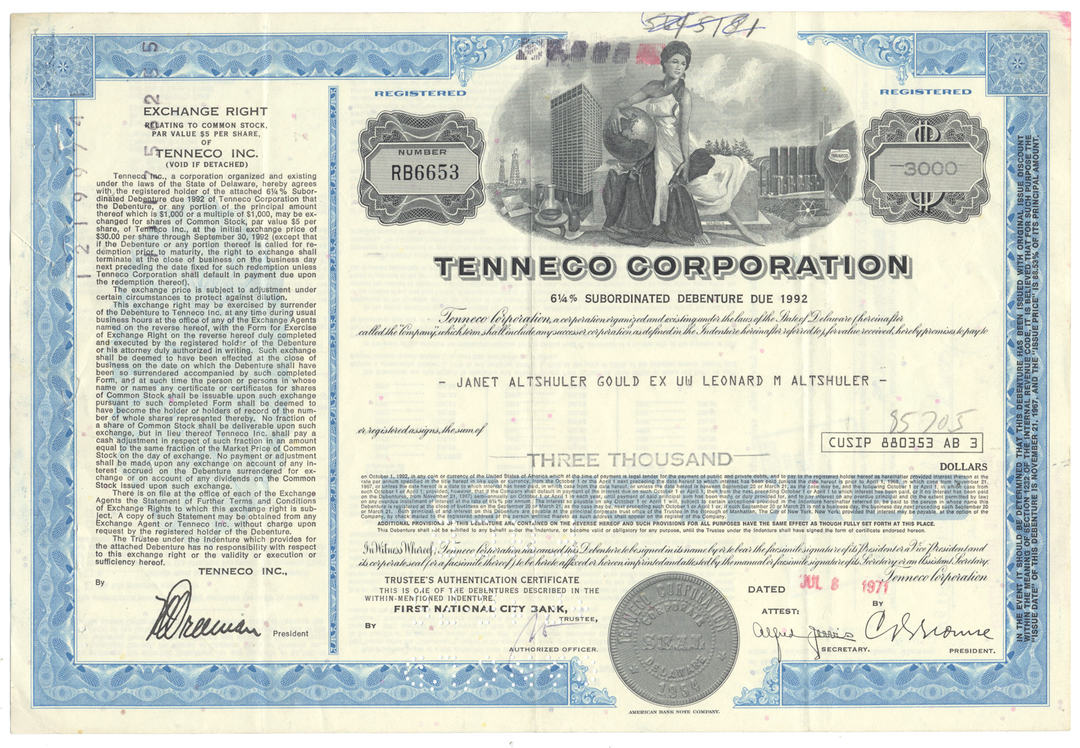

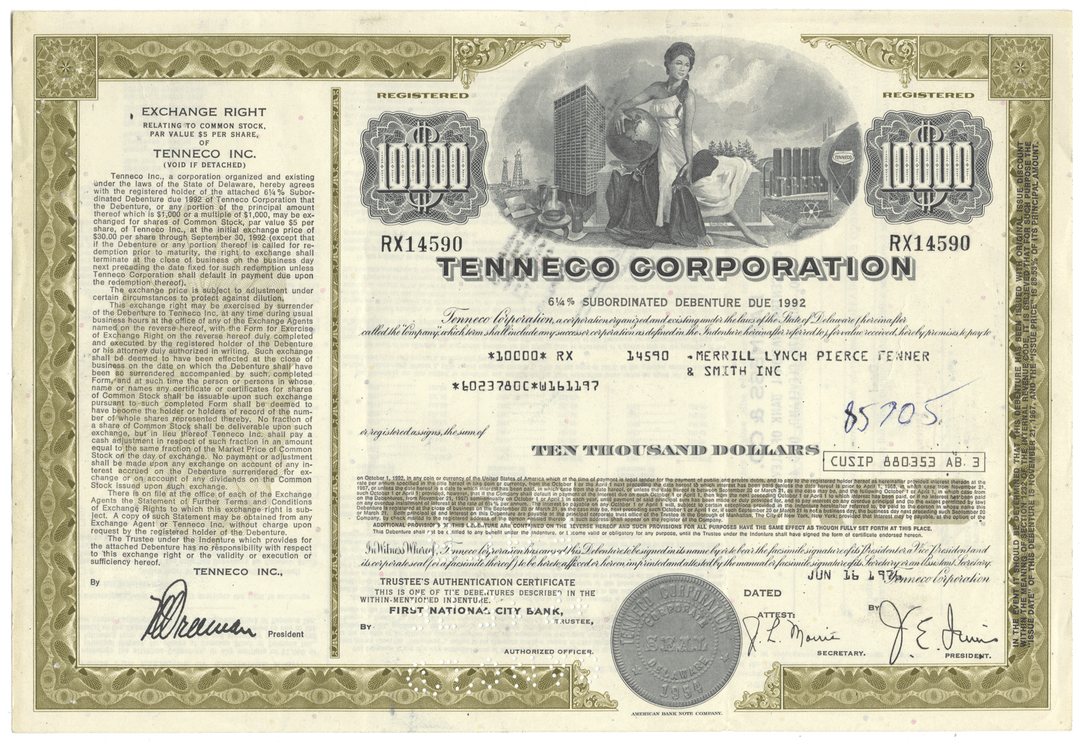

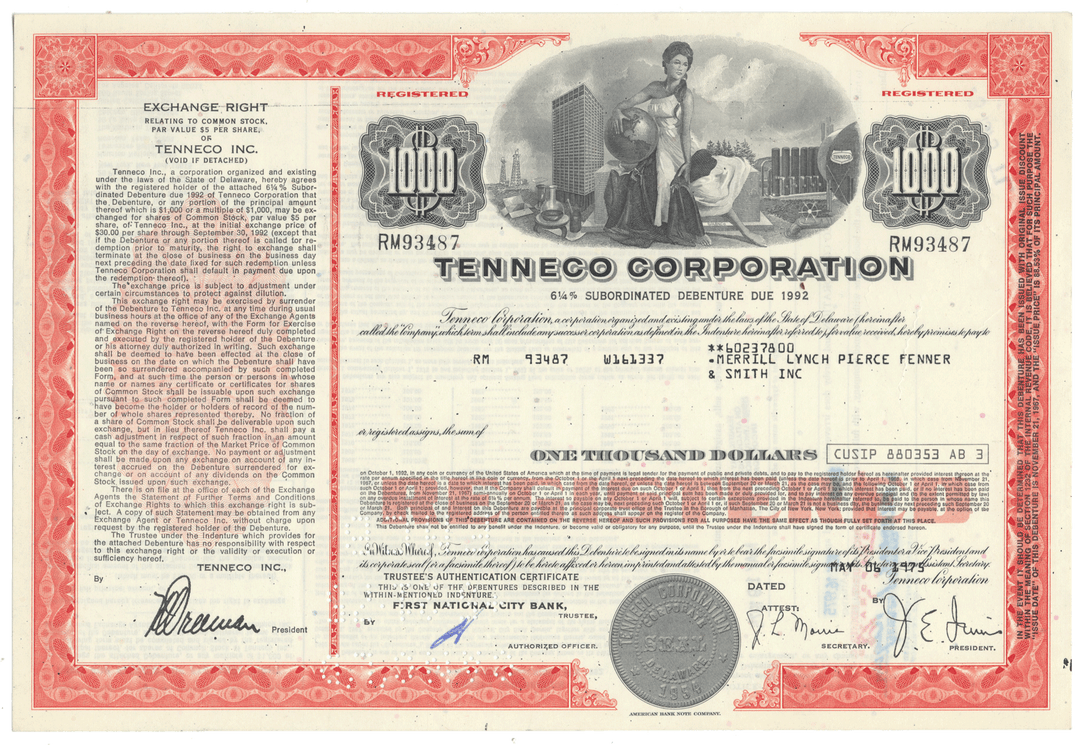

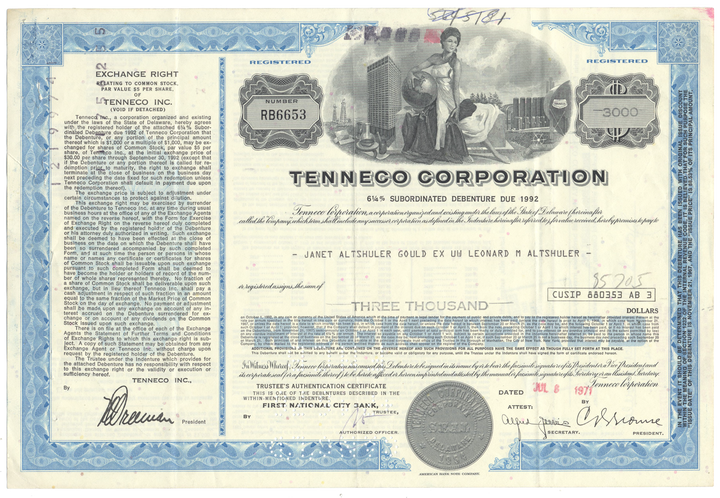

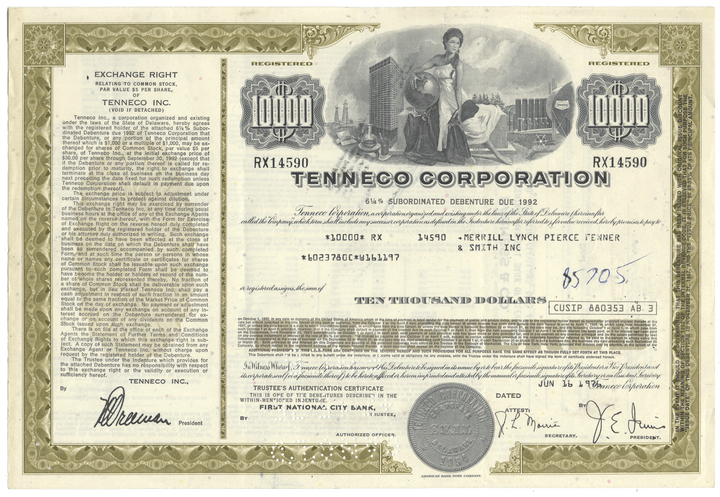

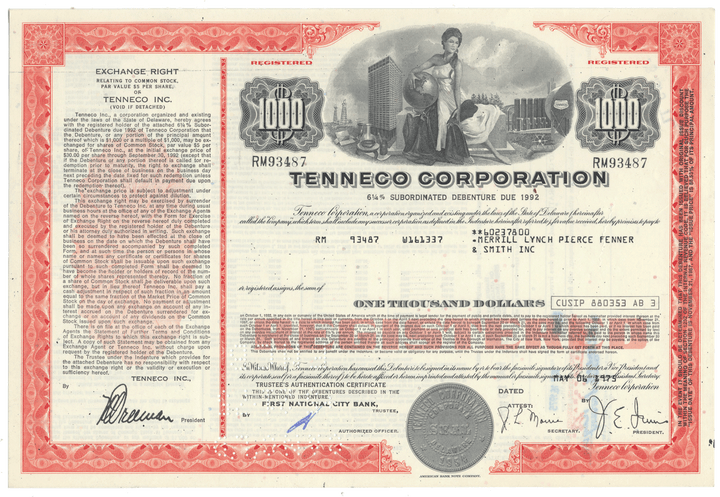

Tenneco Corporation

- Guaranteed authentic document

- Orders over $75 ship FREE to U. S. addresses

Product Details

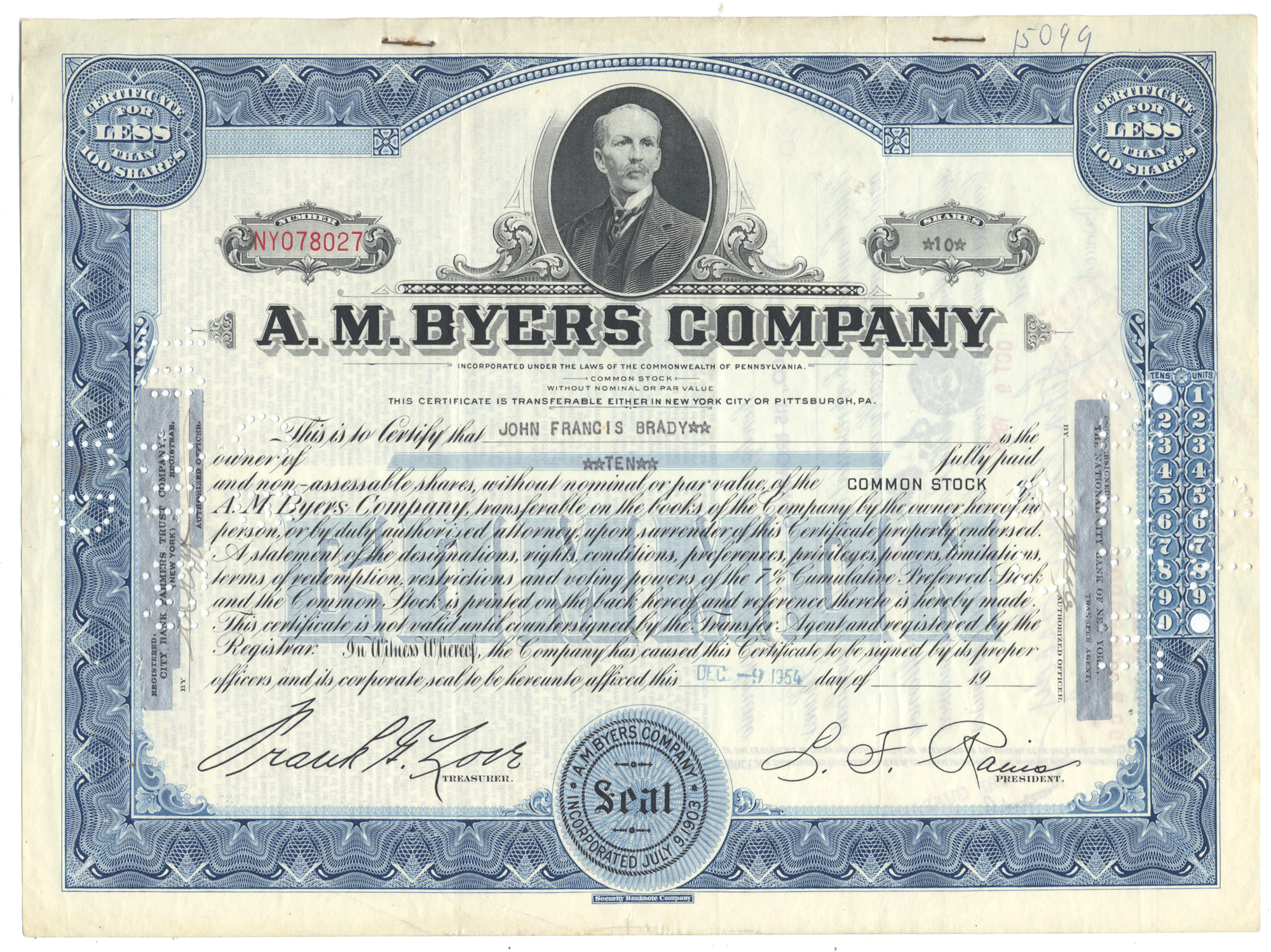

Certificate Type

Subordinated Debenture Bond

Date Issued

July 8, 1971 (blue)

June 16, 1976 (olive)

May 6, 1975 (red)

Canceled

Yes

Printer

American Bank Note Company

Signatures

Machine printed

Approximate Size

12" (w) by 8" (h)

Additional Details

NA

Historical Context

A shortage of fuel for World War II defense industries in the Appalachian area developed when industrial production was increased. The nuclear development operations of the Manhattan Project at Oak Ridge, Tennessee consumed huge quantities of Tennessee Valley Authority electrical power that would have otherwise been available to other industrial operations. The Chicago Corporation was able to acquire a Federal Power Commission (FPC) license to build a pipeline from Texas to Appalachia, eventually expanding to the largest natural gas pipeline network in the United States. These pipelines were acquired by El Paso Corporation in 1996, and are now owned by Kinder Morgan.

Diversification

In the 1950s, the company acquired existing oil companies, including Sterling Oil, Del-Key Petroleum, and Bay Petroleum. The Tennessee division of the Chicago Corporation acquired Tennessee Gas Transmission Company in 1943 to build a natural-gas pipeline 1,265 miles from Texas to West Virginia. The first line was completed in October 1944. It was followed by three additional pipelines totaling 3,840 miles during the next 15 years which provide gas to New York and New Jersey. In 1966, Tennessee Gas was incorporated as Tenneco, Inc. Tenneco expanded into a number of business ventures as a result of diversification.

In 1967, the company acquired Walker, Inc., a manufacturer of universal-fit exhaust mufflers and pipes. The year after, they started working on the construction of a universal-fit catalytic converter, that would become a cost-effective alternative to the OE catalytic converters. It took the company eight years to introduce one. Tenneco bought Houston Oil & Minerals Corporation in the late 1970s. Tenneco owned and operated a large number of gasoline service stations, but all were closed or replaced with other brands by the mid-1990s. In the 1970s, Tenneco purchased 53% of J.I. Case when they purchased its owner Kern County Land Company, the agricultural equipment manufacturer based in Racine, Wisconsin.

In 1972, Tenneco purchased UK-based David Brown Tractors, and merged it with the J.I. Case business. In 1984, Case parent Tenneco bought selected assets of the International Harvester agriculture division and merged it with J.I. Case. All agriculture products are first labeled Case International and later Case IH. Tenneco purchased the articulated 4WD manufacturer Steiger Tractor in 1986, and merged it into Case IH. The new corporate direction was to buy failing companies in a variety of industries, and work to develop them into market leaders. This worked well with Newport News Shipbuilding, but failed miserably with the various tractor companies, probably due in large part to the economy at the time. By 1988, the company was losing $2 million per day.

After being pressured by the banks, it was decided to sell off the oil business. Tenneco Oil Exploration Company was split up and sold off to multiple buyers. By 1994, Tenneco decided to begin getting out of the agricultural business and agreed to sell 35% of the now named Case Corporation. In 1996, the spin-off of Case Corporation was completed. The company was acquired by Fiat in 1999 and merged with New Holland Agriculture to form CNH Global.

Consolidation

Consolidation Tenneco Inc. emerged from a conglomerate consisting of six unrelated businesses: shipbuilding, packaging, farm and construction equipment, gas transmission, automotive, and chemicals. The automotive division was spun off from Tenneco, Inc. in 1991 along with the packaging, energy, natural gas, and shipbuilding divisions. All businesses except automotive and packaging were disposed of between 1994 and 1996 (through public offerings, sales, spin-offs and mergers).

In 1999, Tenneco Packaging was spun off and renamed to Packaging Corporation of America (Pactiv Corporation). On October 28, 2005 Tenneco Automotive was renamed as Tenneco.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.