Rare CITICORP Working Proof

- Guaranteed authentic document

- Orders over $75 ship FREE to U. S. addresses

Product Details

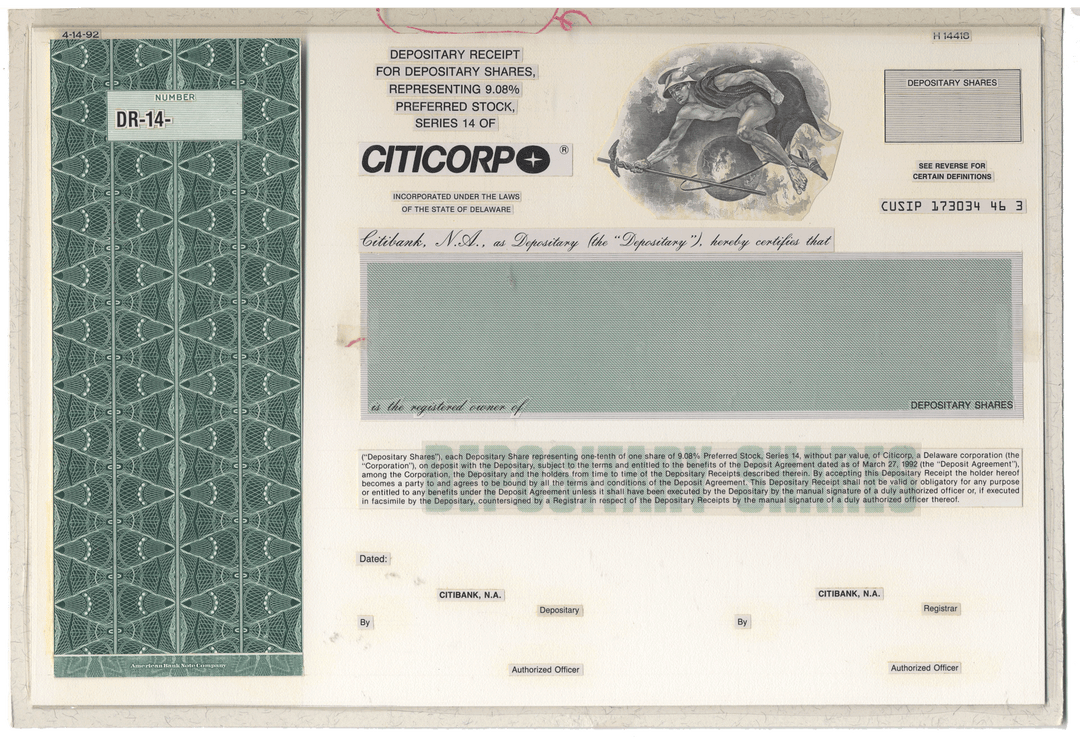

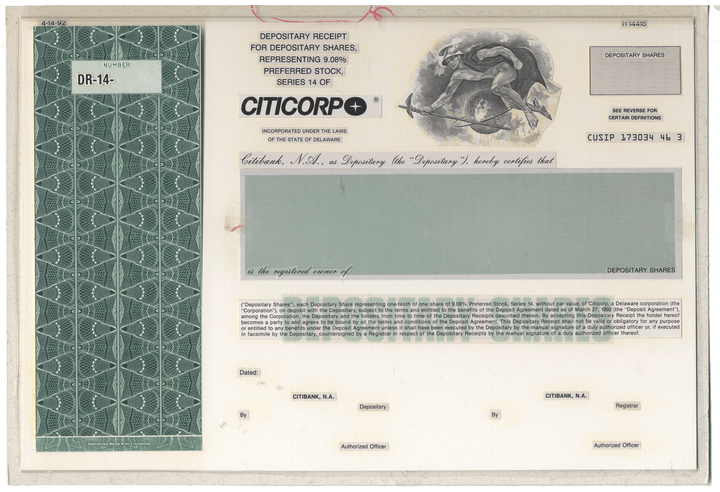

Company

Citicorp, N. A.

Certificate Type

Working Proof for the company's Depositary Shares

Time Period

1980's

Printer

American Bank Note Company

Format & Approximate Size

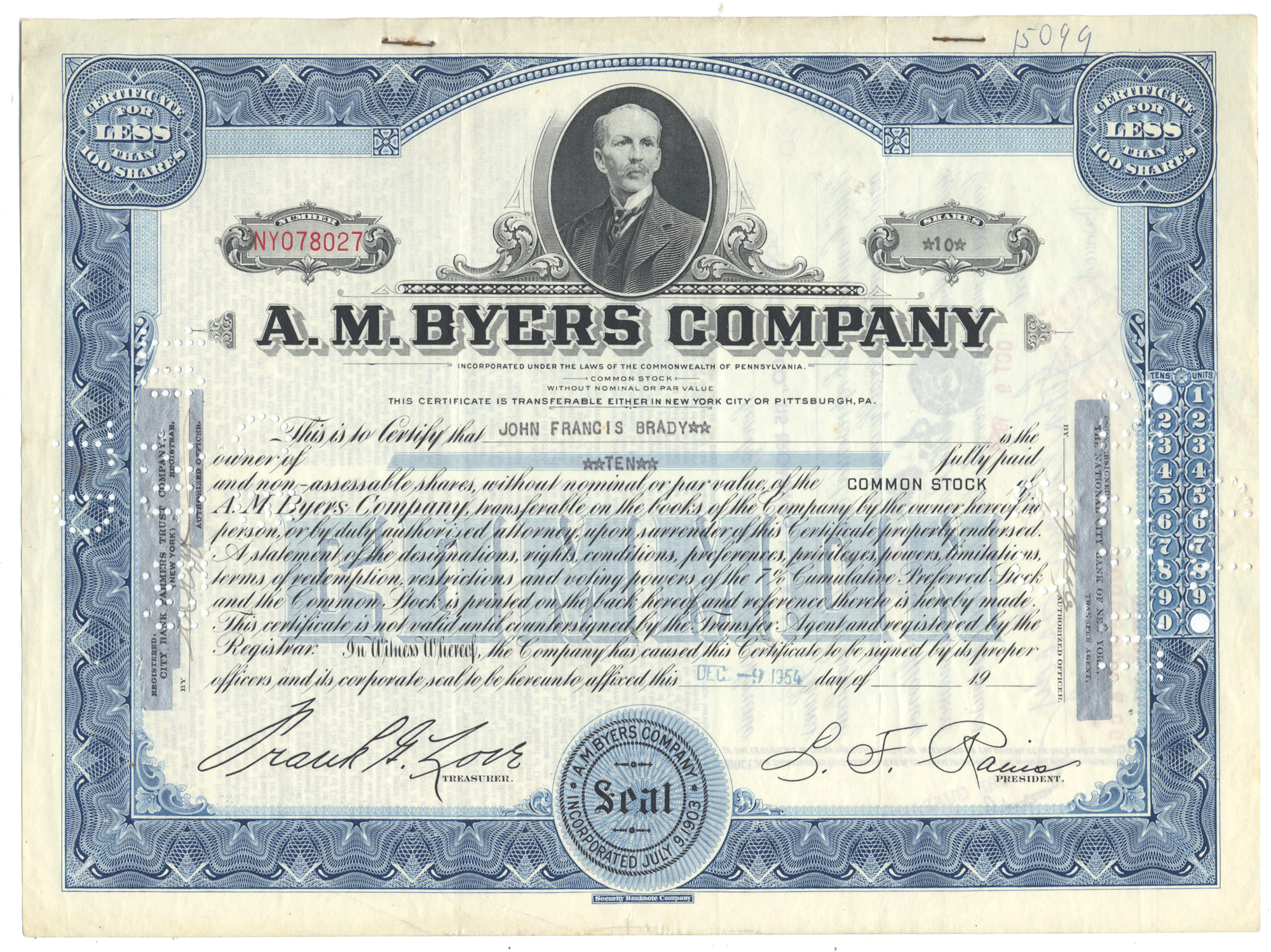

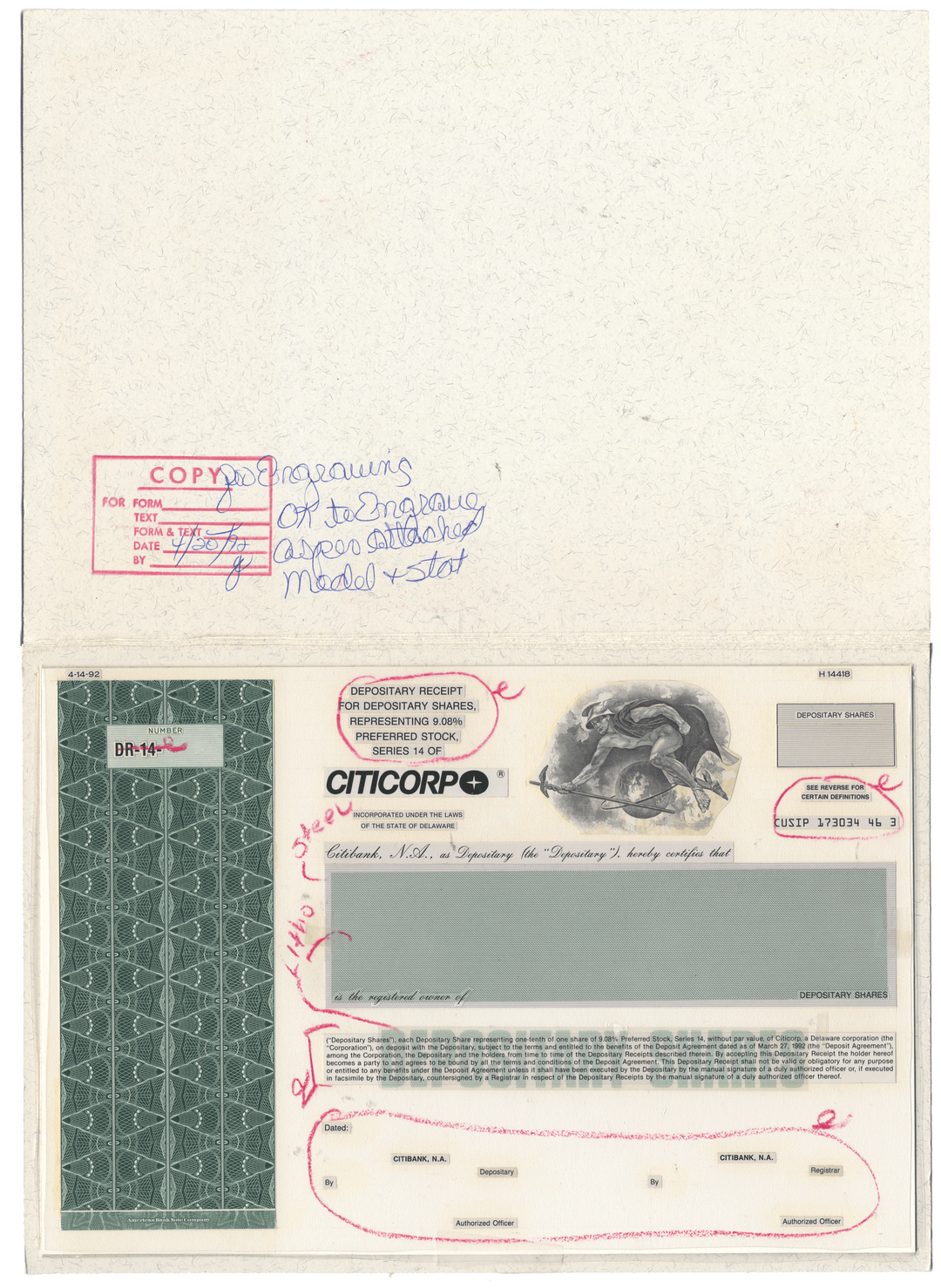

This proof is adhered to a 12" x 8 1/2" cardboard folder. The proof is protected by a "flip up" clear protective and editing layer.

Images

You will receive the exact proof pictured as it is the only one of it's kind. The first picture shows the open folder and the proof with the edit layer lying atop the piece. The second picture shows just the proof with the plastic layer lifted out of view.

Guaranteed Authentic

Yes

Additional Details

Fascinating piece of financial history from this banking giant!

Citibank (formerly City Bank of New York) was chartered by the State of New York on June 16, 1812, with $2 million (~$44.6 million in 2024) of capital. Serving a group of New York merchants, the bank opened for business on September 14 of that year, and Samuel Osgood was elected as the first president of the company. After the Panic of 1837, Moses Taylor acquired control of the company. The company's name was changed to The National City Bank of New York in 1865 after it converted its state charter into a federal charter and joined the new U.S. national banking system. After Taylor died in 1882, Percy Rivington Pyne I became president of the bank. He died nine years later and was replaced by James Stillman. The bank became the largest bank in New York City after the Panic of 1893 and the largest bank in the U.S. by 1895. It became the first contributor to the Federal Reserve Bank of New York in 1913, and the following year it inaugurated the first overseas branch of a U.S. bank in Buenos Aires, although the bank had been active in plantation economies, such as the Cuban sugar industry, since the mid-19th century. The purchase of U.S. overseas bank International Banking Corporation in 1918 helped it become the first American bank to surpass $1 billion in assets. During the United States occupation of Haiti and the bank's income from Haiti's loan debt related to the Haiti indemnity controversy, the bank earned some of its largest gains in the 1920s due to debt payments from Haiti, becoming the largest commercial bank in the world in 1929. As it grew, the bank became an innovator in financial services, becoming the first major U.S. bank to offer compound interest on savings (1921); unsecured personal loans (1928); customer checking accounts (1936) and the negotiable certificate of deposit (1961).

The bank merged with First National Bank of New York in 1955, becoming the First National City Bank of New York in 1955. The "New York" was dropped in 1962 on the 150th anniversary of the company's foundation. The company organically entered the leasing and credit card sectors, and its introduction of U.S. dollar-denominated certificates of deposit in London marked the first new negotiable instrument in the market since 1888. The bank introduced its First National City Charge Service credit card—popularly known as the "Everything card" and later to become MasterCard—in 1967. Also in 1967, First National City Bank was reorganized as a one-bank holding company, First National City Corporation, or "Citicorp" for short. The bank had been nicknamed "Citibank" since the 1860s when it began using this as an eight-letter wire code address.

In 1974, under the leadership of CEO Walter B. Wriston, First National City Corporation changed its formal name to "Citicorp", with First National City Bank being formally renamed Citibank in 1976. Shortly afterwards, the bank launched the Citicard, which pioneered the use of 24-hour ATMs. John S. Reed was elected CEO in 1984, and Citi became a founding member of the CHAPS clearing house in London. Under his leadership, the next 14 years would see Citibank become the largest bank in the United States and the largest issuer of credit cards and charge cards in the world, and expand its global reach to over 90 countries.

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.