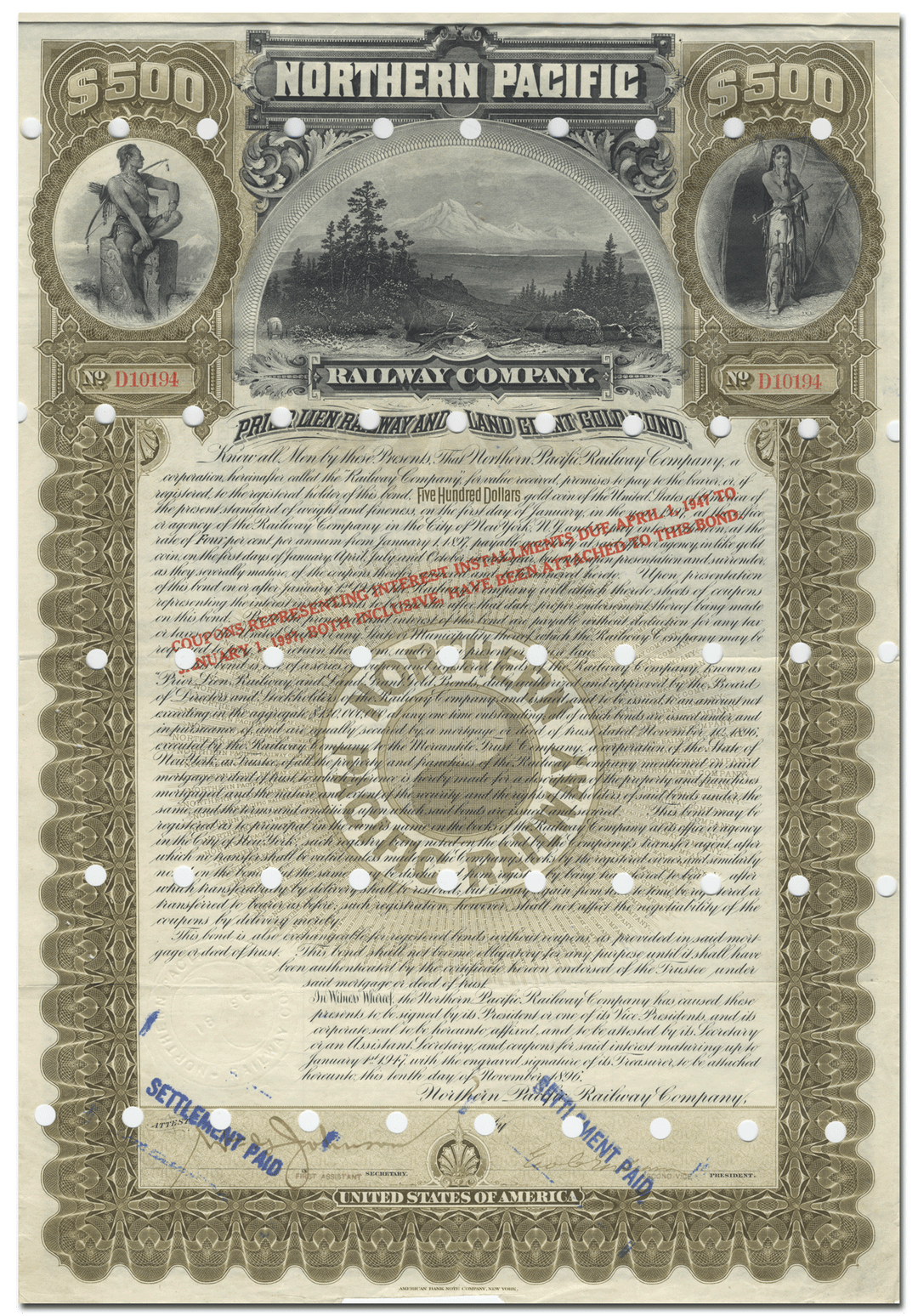

Northern Pacific Railway Company

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Regular price

$ 26.25

$ 26.25

Regular price

$ 75.00

$ 75.00

Sale price

$ 26.25

$ 26.25

Save 65%

/

You will receive the exact certificate pictured

Guaranteed authentic

Over 125 years old

Land grant gold bond

November 10, 1896

Issued, canceled

American Bank Note Company

Hand signed

10" (w) by 14 3/4" (h)

NA

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.