Very Rare Working Proof from BLACKSTONE MUNICIPAL TARGET TERM TRUST (BlackRock)

- Guaranteed authentic document

- Orders over $75 ship FREE to U. S. addresses

Product Details

Company

Blackstone Municipal Target Term Trust Inc.

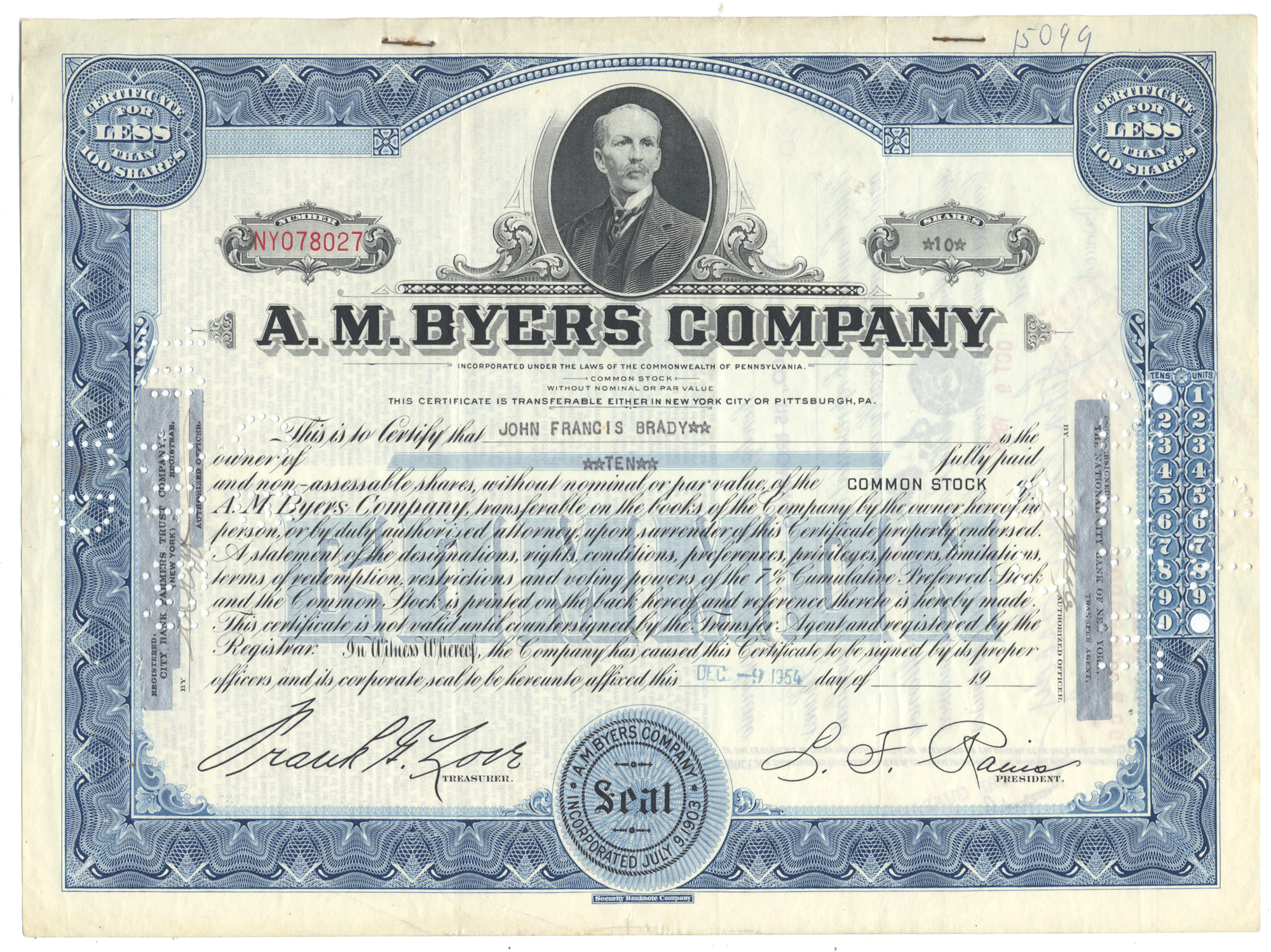

Certificate Type

Working Proof for the company's Common Stock

Time Period

1990's

Printer

American Bank Note Company

Format & Approximate Size

This proof is housed in a traditional 12" x 8 1/2" cardboard folder. The proof is protected by a "flip up" clear protective/editing layer and is adhered to the folder itself.

Images

You will receive the exact proof pictured as it is the only one of it's kind. The first image shows the full flip up folder with the proof at the bottom with protective plastic editing layer atop the piece. The second image shows the proof with the editing layer flipped up and out of the way.

Guaranteed Authentic

Yes

Additional Details

Fascinating piece of financial history. Blackstone Inc. is an American alternative investment management company based in New York City. It was founded in 1985 as a mergers and acquisitions firm by Peter Peterson and Stephen Schwarzman, who had previously worked together at Lehman Brothers. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate across the globe. Blackstone is also active in credit, infrastructure, hedge funds, secondaries, growth equity, and insurance solutions. As of September 30, 2025, Blackstone has $1.2 trillion in total assets under management, making it the world's largest alternative investment firm.

Blackstone also ventured into other businesses, most notably investment management. In 1987 Blackstone entered into a 50–50 partnership with the founders of BlackRock, Larry Fink (current CEO of BlackRock), and Ralph Schlosstein (CEO of Evercore). The two founders, who had previously run the mortgage-backed securities divisions at First Boston and Lehman Brothers, respectively, initially joined Blackstone to manage an investment fund and provide advice to financial institutions. They also planned to use a Blackstone fund to invest in financial institutions and help build an asset management business specializing in fixed income investments.

This proof appears to be one of those funds, as Schlosstein is a signatory on the piece.

In 1995, Blackstone sold its stake in BlackRock to PNC Financial Services for $240 million. Between 1995 and 2014, PNC reported $12 billion in pretax revenues and capital gains from BlackRock. Schwarzman later described the selling of BlackRock as his worst business decision ever.

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.