Armour-Dial, Inc.

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

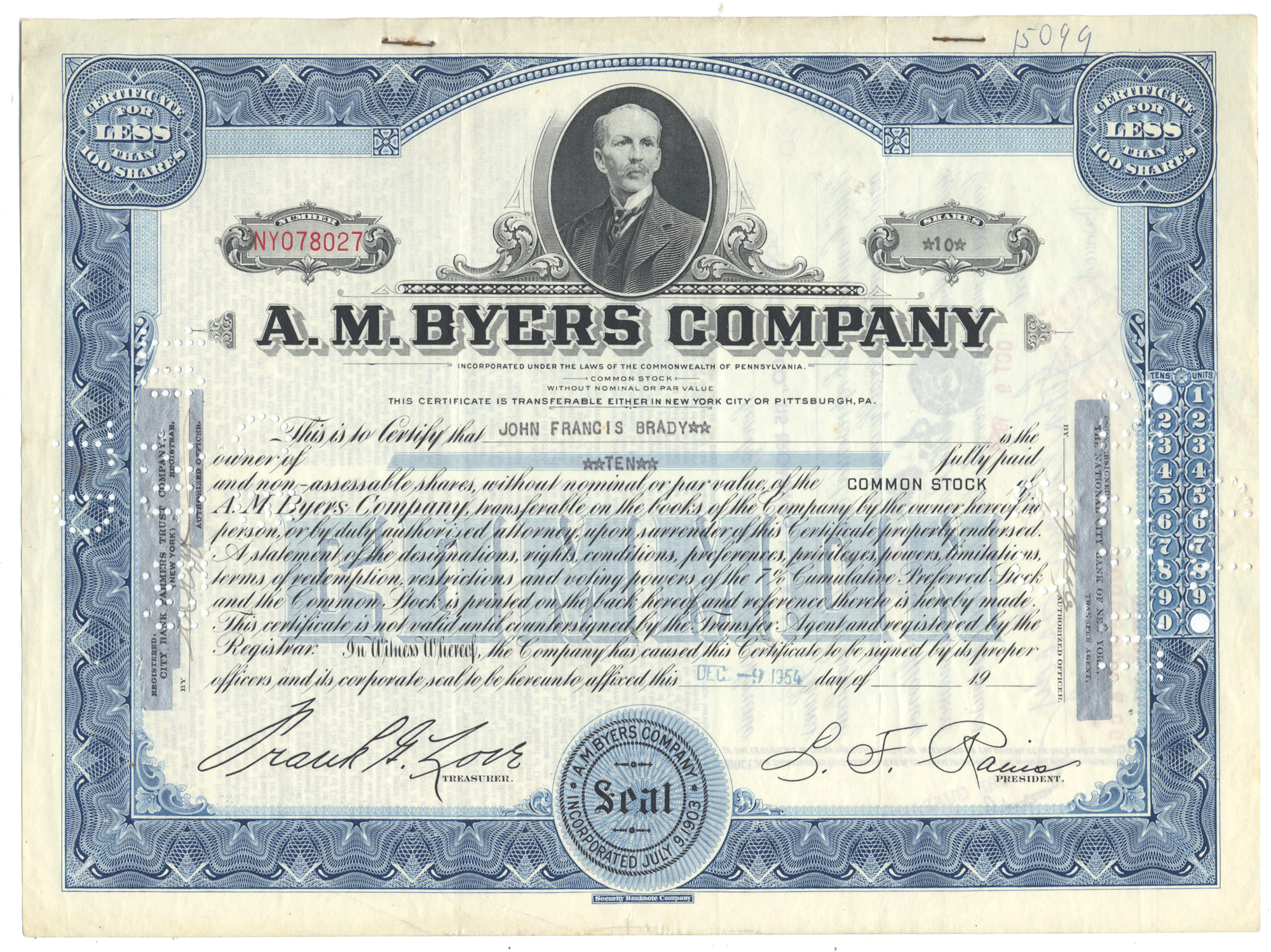

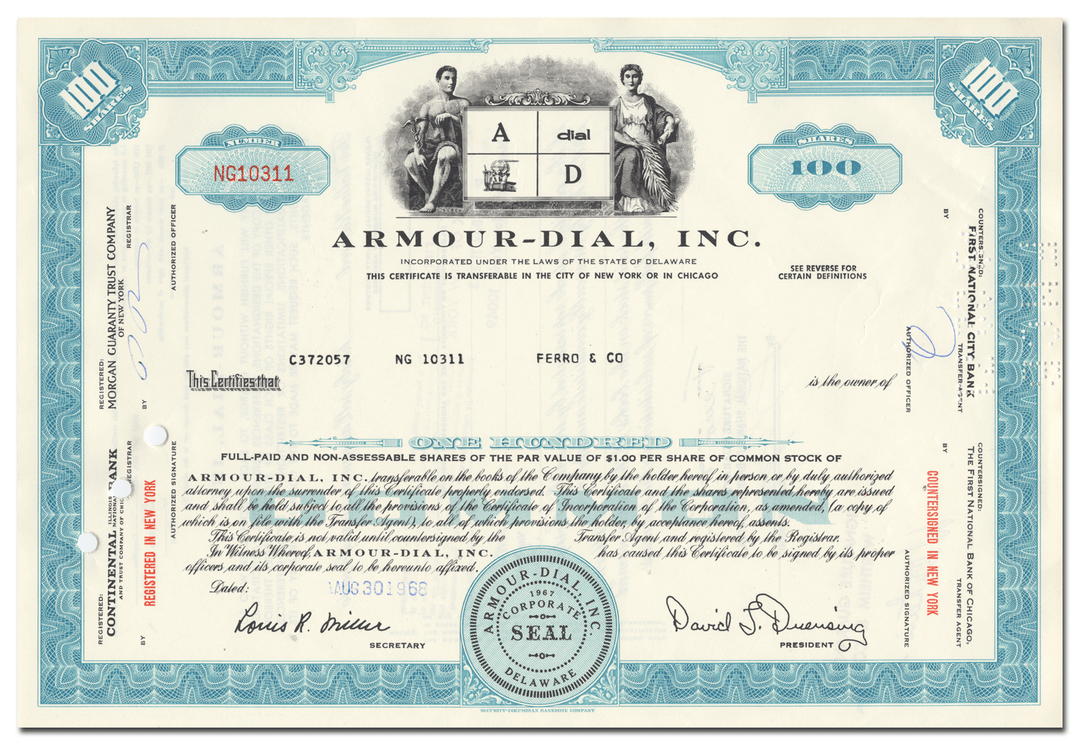

Product Details

CompanyArmour-Dial, Inc.

Certificate Type

Common Stock

Date Issued

1960's and 1970's

Canceled

Yes

Printer

Security-Columbian Bank Note Company

Signatures

Machine printed

Approximate Size

12" (w) by 8" (h)

Images

Representative of the piece you will receive

Guaranteed Authentic

Yes

Additional Details

NA

Historical Context

Armour and Company had its roots in Milwaukee, where in 1863 Philip D. Armour joined with John Plankinton (the founder of the Layton and Plankinton Packing Company in 1852) to establish Plankinton, Armour and Company. Together, the partners expanded Plankinton's Milwaukee meat packing operation and established branches in Chicago and Kansas City and an exporting house in New York City. Armour and Plankinton dissolved their partnership in 1884 with the Milwaukee operation eventually becoming the Cudahy Packing Company.

In its early years, Armour sold every kind of consumer product made from animals: meats, glue, oil, fertilizer, hairbrushes, buttons, oleomargarine, and drugs, made from slaughterhouse byproducts. Armour operated in an environment without labor unions, health inspections, or government regulation. Accidents were commonplace. Armour was notorious for the low pay it offered its line workers. It fought unionization by banning known union activists and breaking strikes in 1904 and 1921 by employing African Americans and new immigrants as strikebreakers. The company did not become fully unionized until the late 1930s when the meatpacking union succeeded in creating an interracial industrial union as part of the Congress of Industrial Organizations.

During the Spanish–American War (1898), Armour sold 500,000 pounds of beef to the US Army. An army inspector tested the meat two months later and found that 751 cases were rotten and had contributed to the food poisoning of thousands of soldiers.

In the first decade of the 20th century, a young Dale Carnegie, representing the South Omaha sales region, became the company's highest-selling salesman, an experience he drew on in his best-selling book, How to Win Friends and Influence People.

In the early 1920s, Armour encountered financial troubles and the family sold its majority interest to financier Frederick H. Prince. The firm retained its position as one of the largest American firms through the Great Depression and the sharp increase in demand during World War II. During this period, it expanded its operations across the United States; at its peak, the company employed just under 50,000 people.

In 1948, Armour, which had made soap for years as a byproduct of the meatpacking process, developed a deodorant soap by adding the germicidal agent AT-7 to soap. This limited body odor by reducing bacteria on the skin. The new soap was named Dial because of its 24-hour protection against the odor-causing bacteria. Armour introduced the soap with a full-page advertisement using scented ink in the Chicago Tribune. During the 1950s, Dial became the best-selling deodorant soap in the US. The company adopted the slogan "Aren't you glad you use Dial? Don't you wish everybody did?" in 1953. In the 1960s, the Dial brand was expanded to include deodorants and shaving creams. Because of the popularity and strong sales of Dial brand, fueled by magazine, radio, and television advertising, Armour's consumer-products business was incorporated as Armour-Dial, Inc. in 1967.

1970-1985

In 1970, Armour and Company was acquired by Chicago-based bus company Greyhound Corporation after a hostile takeover attempt by General Host Corporation a year before. In 1971, Greyhound relocated Armour's headquarters from Chicago to Phoenix, Arizona, to a new $83-million building. Rock icon Stevie Nicks' father, Jess Nicks, who was a Greyhound executive, became president of Armour.

In 1978, Greyhound sold Armour Pharmaceuticals to Revlon. Revlon sold its drug unit in 1985 to Rorer (later known as Rhône-Poulenc Rorer). Forest Laboratories acquired the rights to Armour Thyroid from Rhone-Poulenc Rorer in 1991. The remaining assets of Armour Pharmaceuticals are now part of CSL Behring.

Greyhound's rapid diversification and frequent unit restructurings led to erratic profitability. In 1981, John W. Teets was appointed chairman of Greyhound and began selling unprofitable subsidiaries. After meat packers struck at the Armour plants in the early-1980s, Teets shut 29 facilities and sold Armour Food Company to ConAgra in 1983, but kept the Armour Star canned meat business. Armour-Dial continued to manufacture the canned meat products using the Armour Star trademark under license from ConAgra.

1985-2000

In 1985, Greyhound acquired the household products business of Purex Industries, Inc. in 1985 and combined it with Armour-Dial to form The Dial Corporation.

In late 1995, parent company Greyhound (renamed The Dial Corp in 1991) announced its intention to spin off the Dial consumer-products business. Afterwards, Dial's former parent company was renamed Viad Corp, consisting of the service businesses. The Dial consumer business was reborn as the new Dial Corporation, relocating its corporate offices to Scottsdale, Arizona, adjacent to its long-time research and development facility. Under new CEO Malcolm Jozoff, a former P&G executive, the new Dial Corporation underwent major layoffs in the fall of 1996 and a series of financially disastrous acquisitions the following four years. In 2000, Jozoff was replaced by Herbert Baum with a mandate from the board of directors to find a suitable buyer for the company.

2000–Present

Dial was acquired by Henkel KGaA of Düsseldorf, Germany in March 2004. The food business of Dial, including Armour Star canned meats, was sold to Pinnacle Foods in March 2006. In 2007 Pinnacle Foods was acquired by the Blackstone Group, a New York City-based private equity firm.

In July 2006, ConAgra sold most of their refrigerated meats businesses, including the Armour brand, to Smithfield Foods.

In June 2018, Conagra announced it would acquire Pinnacle Foods for $8.1 billion.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.