Magma Copper Company

- Guaranteed authentic document

- Orders over $100 ship FREE to U. S. addresses

Product Details

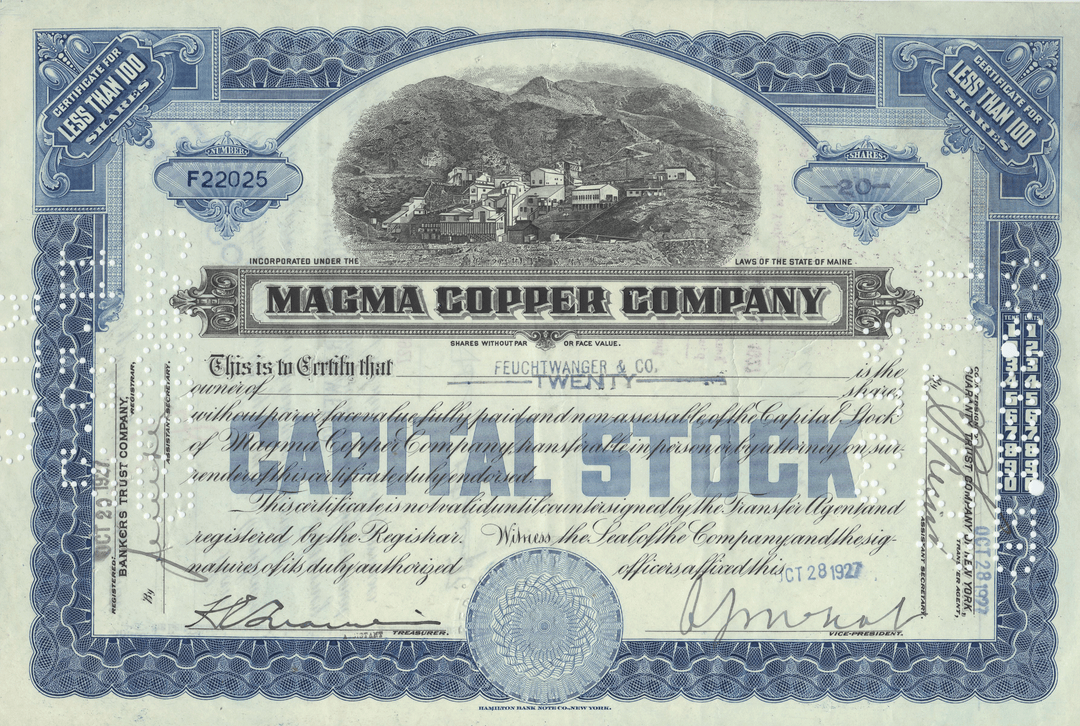

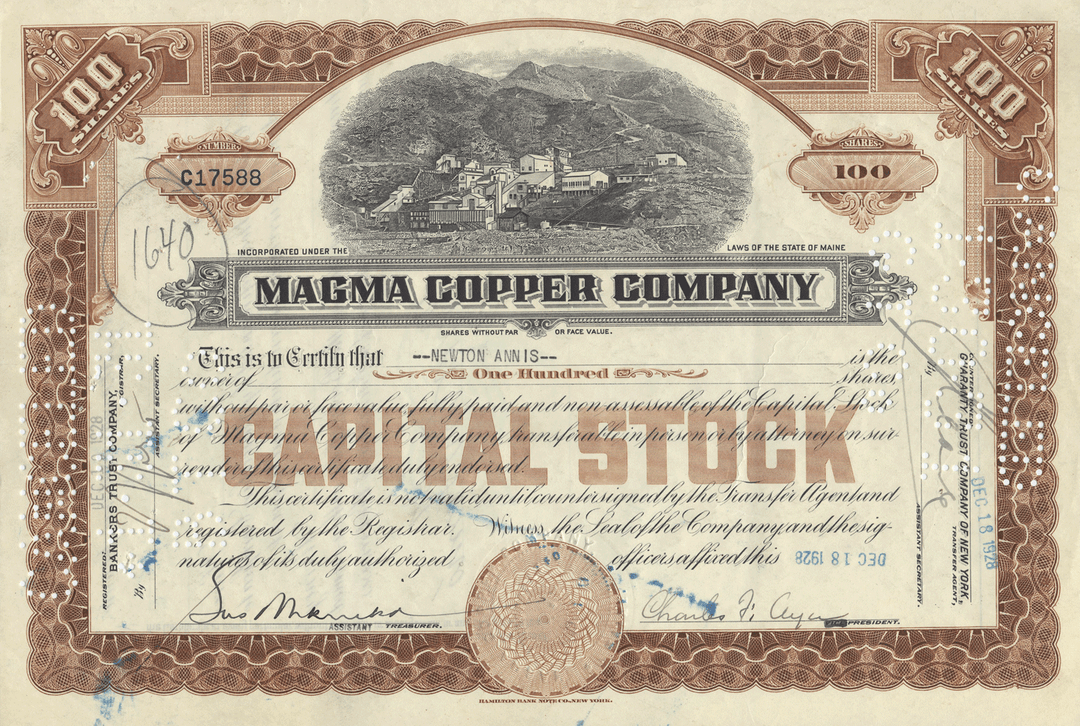

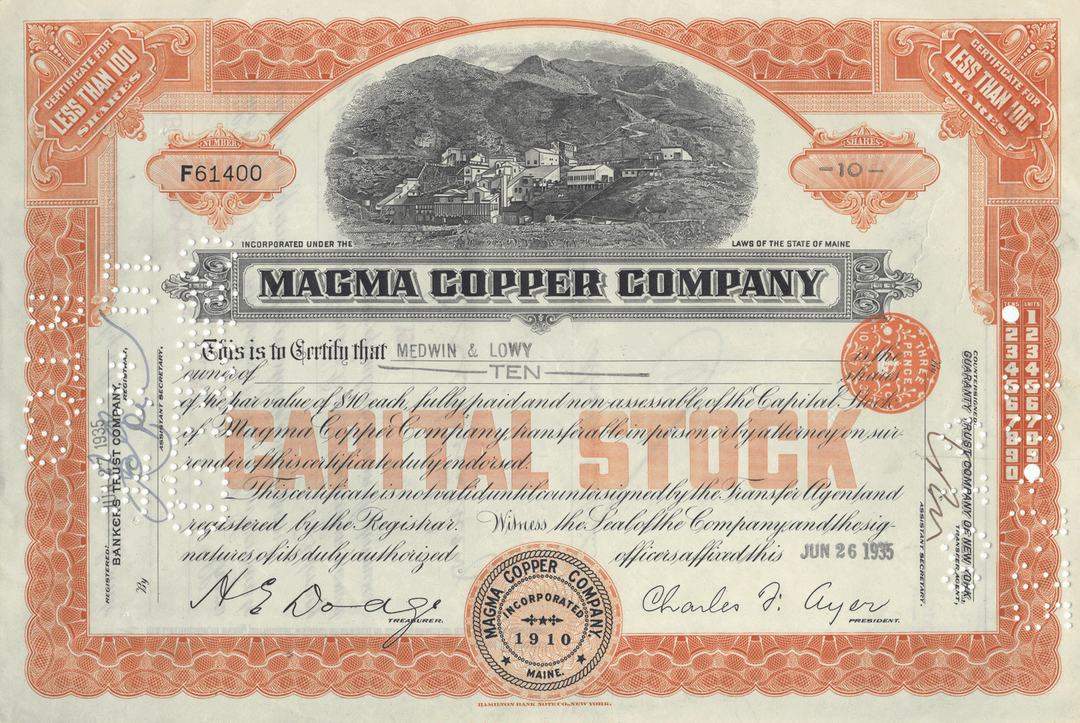

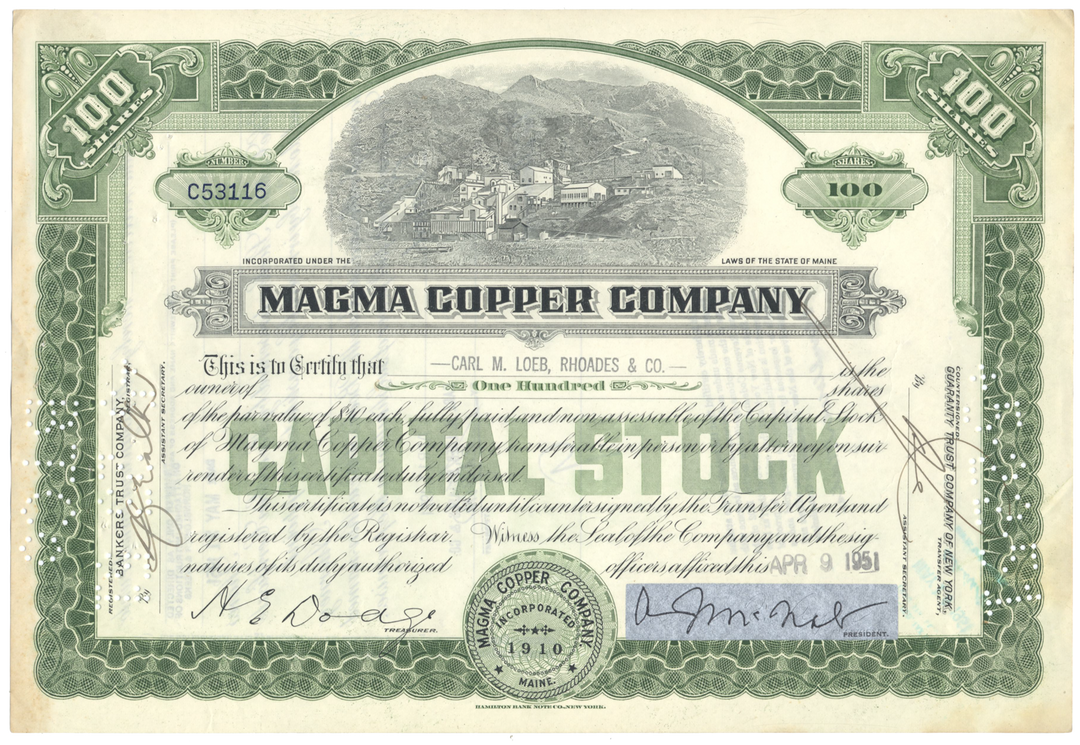

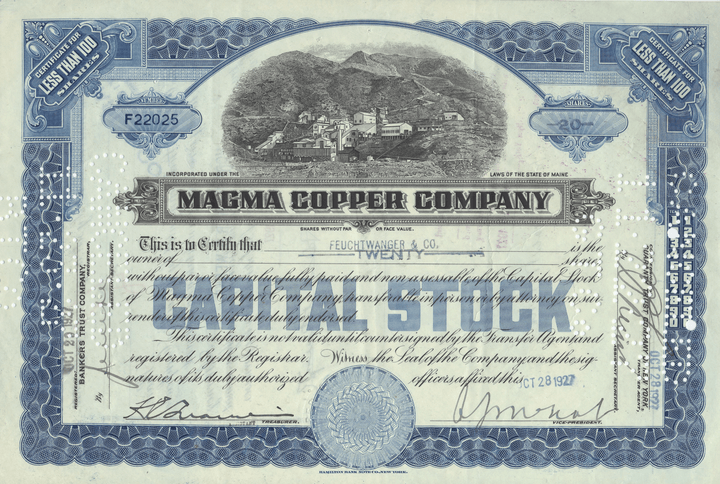

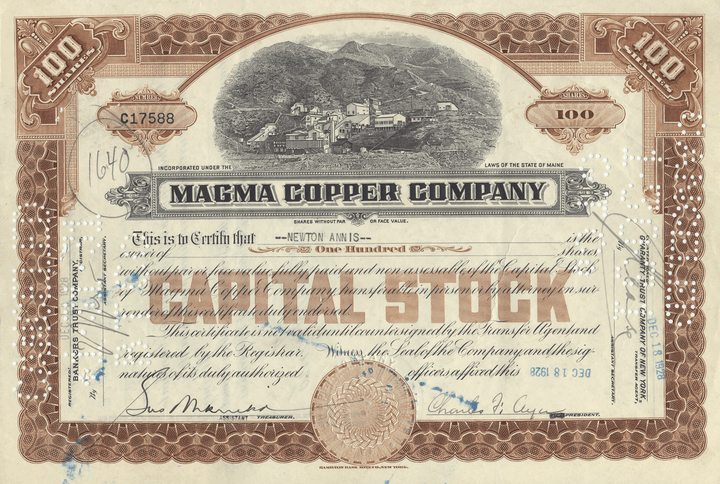

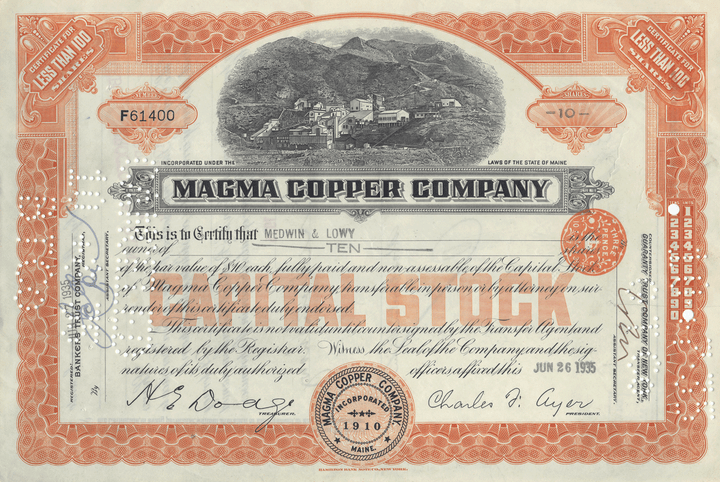

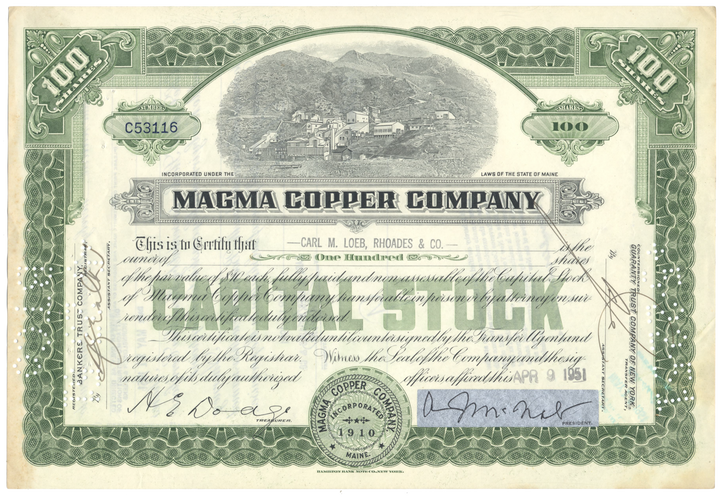

| Company | Magma Copper Company |

| Certificate Type | Capital Stock |

| Date Issued | 1920's, 1930's and 1950's |

| Canceled | Yes |

| Printer | Hamilton Bank Note Company |

| Signatures | Hand signed |

| Approximate Size |

12" (w) by 8" (h) |

|

Product Images |

Representative of the piece you will receive |

| Authentic | Yes |

| Additional Details | NA |

Historical Context

In 1877, production began at the Silver Queen Mine in the Hastings Pioneer Mining District in the Arizona territory. This district later became Superior, and it was here that the Magma Copper Company was organized in 1910, holding the Silver Queen mining property. The company's founder was Colonel William Boyce Thompson, a mining engineer turned Wall Street trader, who went on to create Newmont Mining Corporation eleven years later as a holding company for his collection of mining investments, his holding in Magma prominent among them. Magma's underground mine at Superior first went into production in 1912. In 1914, the Magma Arizona Railroad Company was founded, linking the Superior site with the Southern Pacific Railroad system about 28 miles away. Magma's first smelter was constructed at Superior in 1924.

Magma gradually rose through the ranks during the 1930s and 1940s, and by 1950 was the eighth largest copper producer in the United States.

In 1944, Magma consolidated and purchased the bulk of the San Manuel mineral claims, and began its own program of drilling and exploration. Underground exploration and development at San Manuel began four years later. It soon became clear that San Manuel was a major copper discovery, containing what was estimated at the time as 480 million tons of copper ore, with the existence of further orebodies nearby suspected. The cost of developing the mine, plant, community, and railroad was estimated at $111 million, and to help offset this, Magma borrowed $94 million from the U.S. government in 1952. Construction on the surface plant began the following year.

Production at San Manuel began in 1956, with the first stopes undercut and the start-up of smelting operations there. With the flow of copper from San Manuel's 500 million-ton reserves, Magma soon jumped from eighth to fourth-largest among copper producers in the United States. Nevertheless, because of the vast sums being poured into the development of San Manuel, Magma's potential as a big money-earner appeared to be years away from fruition. Dividends had been suspended in 1949, shortly after the acquisition of San Manuel, and their reinstatement did not seem likely until the huge government loan could be retired, an event not scheduled to occur until 1973. Between 1956 and 1962, the value of Magma common stock was cut in half.

Nevertheless, Magma's potential was recognized by the management of Newmont Mining. In 1962, Newmont acquired 784,842 additional shares of Magma stock, offering Magma stockholders three-fourths of a share of Newmont preferred stock for each Magma share. Added to the 285,961 Magma shares that Newmont already owned, this gave Newmont 80.6 percent ownership of Magma. The acquisition was part of Newmont president Plato Malozemoff's strategy of domestic investment, thereby reducing the company's reliance on foreign holdings, particularly those in southern Africa. Over the years, the share of Newmont's income originating abroad had grown to well over 50 percent. As part of the deal, Malozemoff was able to refinance Magma's government loan, enabling Magma to resume paying dividends. Following the acquisition, the Justice Department charged Newmont, Magma, and Phelps Dodge with antitrust violations, based on interlocking directorships and Magma's 3 percent interest in Phelps Dodge. Newmont was ordered to divest Magma. This order was successfully dodged, however, and Newmont satisfied the Justice Department by getting rid of its Phelps Dodge holdings and removing the Phelps Dodge directors from its own board.

Magma continued to increase its production capacity throughout the 1960s. In 1965, expansion at San Manuel raised its daily ore output from 30,000 to 40,000 tons. In 1968, Magma purchased the Kalamazoo, Arizona copper property of the Houston-based Quintana Minerals Ltd. for $27 million. The purchase of the Kalamazoo orebody roughly doubled the size of Magma's copper reserves up to one billion tons. The Kalamazoo mine was located about a mile west of San Manuel, and although its size and composition were much like those of San Manuel, its ore lay much deeper, beginning at about 2,500 feet below the surface. The acquisition was a three-way deal, with Quintana receiving about 42,000 shares and $15 million from Magma, plus about $5 million and 72,000 shares from Newmont. Newmont in turn received 170,000 shares of Magma common stock. Magma's net income was $10.9 million in 1968, lower than expected due to strikes in the copper industry.

Magma was fully merged into Newmont Mining Corporation in 1969. In return for each share of Magma, minority stockholders received .85 share of newly issues Newmont convertible preferred stock valued at $4.50 per share. The merger, which made Magma a wholly owned subsidiary of Newmont, contributed to Newmont's shift toward reliance on domestic income.

Related Collections

Additional Information

Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied. All items offered are collectible in nature only. So, you can frame them, but you can't cash them in!

All of our pieces are original - we do not sell reproductions. If you ever find out that one of our pieces is not authentic, you may return it for a full refund of the purchase price and any associated shipping charges.